Financial Accounts Income and Employment

Collecting information about financial accounts to verify income and employment.

Overview

Income and employment verification through financial account data is a modern and efficient method to validate financial and employment status. Leverage digital records from banks, credit unions, or other financial institutions, to view real-time insights into a person's income streams, transaction history, and employment deposits. Traditional methods involving manual document submissions may be cumbersome and prone to errors or falsification.

Use financial data for verification for multiple use cases like the examples below.

- Lenders quickly assessing loan eligibility

- Landlords evaluating tenant applications

- Employers confirming a potential hire's employment history

- Social service agencies determining benefits or assistance eligibility

These data-driven verifications are immediate and accurate. They streamline processes, reduce fraud, and ensure better decision making across sectors.

Configuring using Financial Accounts as VOIE

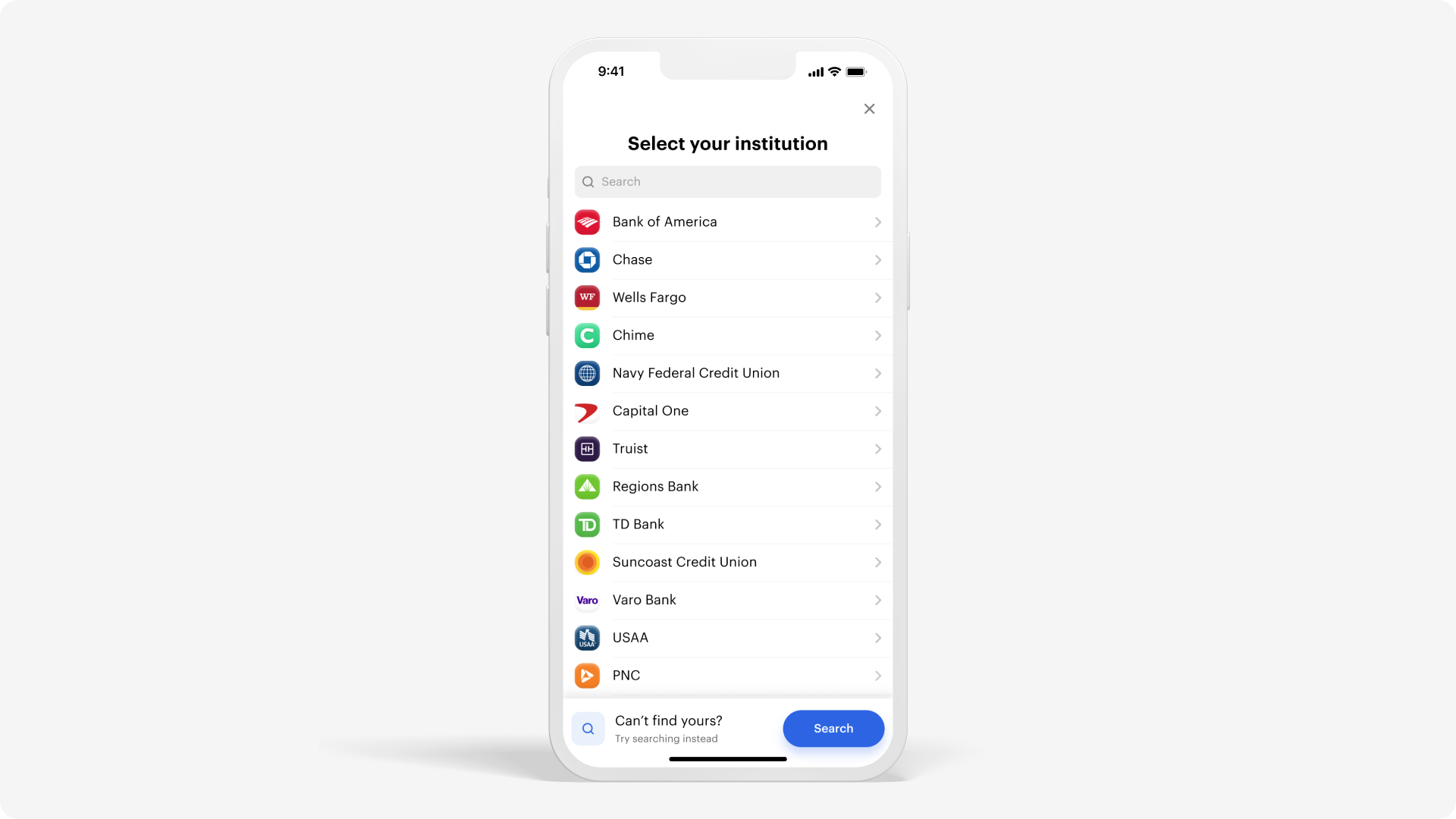

Truv simplifies connecting your users to their financial institution. Users can select their bank or credit union in Truv Bridge from the list of most popular financial institutions. They can also look for their financial institution in the search field at the top of the screen.

Bridge token specifications

When creating a Bridge Token for the User, additional values in the request are required. Include the product_type = income and data_sources = ["financial_accounts"] in the configuration from the cURL sample below.

curl --request POST \

--url https://prod.truv.com/v1/users/{user_id}/tokens/ \

--header 'X-Access-Client-Id: {{client_id}}' \

--header 'X-Access-Secret: {{access_key}} ' \

--header 'accept: application/json' \

--header 'content-type: application/json' \

--data '

{

"product_type": "income",

"data_source": ["financial_accounts"],

"tracking_info": "any data for tracking current transaction"

}

'

Income Reports

Truv income reports share a comprehensive view of the user’s financial account. This information is an overview and includes historical information. This gives decision makers as much information as possible about a user’s financial account.

Endpoints

These endpoints provide a comprehensive collection of financial account information from a user. View detailed information on the attributes and responses using the Income Report API reference page.

Example response

The JSON example below contains payload information from income reports.

{

"status": "success",

"completed_at": "2022-05-04T11:30:00Z",

"days_requested": 61,

"tracking_info": "any string",

"provider": "bank_of_america",

"access_token": "99dd17074ac94aa9ace2621d657c7610",

"companies": [

"my employer"

],

"accounts": [

{

"id": "24d7e80942ce4ad58a93f70ce4115f5c",

"created_at": "2022-05-04T11:30:00Z",

"updated_at": "2022-05-04T12:00:00Z",

"type": "CHECKING",

"subtype": "MONEY_MARKET",

"mask": "string",

"nickname": "My account",

"owners": [

{

"id": "2b623fa2fa9e49cea17d9692caa884c5",

"full_name": "string",

"email": "[email protected]",

"phone": "string",

"address": {

"street": "1 Morgan Ave",

"city": "Los Angeles",

"state": "CA",

"zip": "90210",

"country": "US"

},

"relation_type": "AUTHORIZED_USER"

}

]

}

],

"income": [

{

"start_date": "2022-05-04",

"end_date": "2022-05-04",

"account_id": "24d7e80942ce4ad58a93f70ce4115f5c",

"income_description": "My Employer direct deposit",

"income_category": "Income: Paycheck",

"avg_deposit_amount": 0,

"avg_gross_deposit_amount": 0,

"pay_frequency": "M",

"total_amount": "200.31",

"iso_currency_code": "USD",

"transaction_count": 1,

"historical_summary": [

{

"start_date": "2022-05-04",

"end_date": "2022-05-04",

"total_amount": "200.31",

"iso_currency_code": "USD",

"transactions": [

{

"amount": "200.31",

"iso_currency_code": "USD",

"date": "2022-05-04",

"check_number": "string",

"description": "string",

"pending": true,

"transaction_id": "3fa85f64-5717-4562-b3fc-2c963f66afa6"

}

]

}

]

}

],

"summary": {

"start_date": "2022-05-04",

"end_date": "2022-05-04",

"income_sources_count": 1,

"income_categories_count": 1,

"income_transactions_count": 1,

"total_amount": "200.31",

"iso_currency_code": "USD"

},

"is_suspicious": false

}Income sources

An income source on the Bank Income report is one that is:

- established, with at least 3 deposits

- recurring, with a frequency of weekly, bi-weekly, semi-monthly, or monthly

- current, with the most recent deposit not more than 3 pay periods old

- low variability, with major outliers trimmed out

Bonus pay

Scenarios to consider

- When a bonus has a different transaction description (not common)

- e.g. you are paid regularly as "Dir Deposit from Truv" and then occasionally "Bonus - Annual"

- the bonus would be excluded because it is not one of our standard frequencies (weekly, bi-weekly, semi-monthly, or monthly). Same for a quarterly bonus.

- if the bonus did have a regular frequency (say, monthly) and satisfied the other income criteria above, then it would be on the report

- When a bonus has the same/similar transaction description as regular pay - more common

- The bonus amount is much larger than regular pay

- e.g. borrower is paid regularly "Dir Deposit from Truv: $500" and then occasionally "Dir Deposit from Truv: $10,000"

- the bonus will be excluded from the income source. Truv removes outlier deposits (either v.small - e.g expense reimb, and v.large - e.g. bonus) from an income source so that the avg_pay_amount is useful for annualizing income.

- The bonus amount is similar to regular pay

- e.g. borrower is paid regularly "Dir Deposit from Truv" and it ranges from $1,000 to $2,000

- all of these deposits will contribute to the income source. In reality, Truv doesn't have information from the bank account to know if these include OT or Commission or Per-diem.

- The bonus amount is much larger than regular pay

Updated 6 months ago