Automated Service Ordering (ASO) set up in Encompass®

Automate VOIE and VOA ordering within Encompass® (SmartClient/Desktop and web editions) using ASO

Overview

Encompass® (desktop and web editions) offers support for automatic service orders (ASO) when a loan fulfills certain conditions. This is referred to as Automated Service Ordering or ASO.

Any Encompass® Partner Connect, EPC integration can be configured by a lender administrator to submit automated orders. This powerful feature is designed to reduce the manual workload for lenders' personnel.

Key Benefits

- Enhanced Productivity

- Cost Efficiency

- Increase Underwriting efficiency

- Eliminate duplicate or unnecessary verification orders

- Reduce operations burden

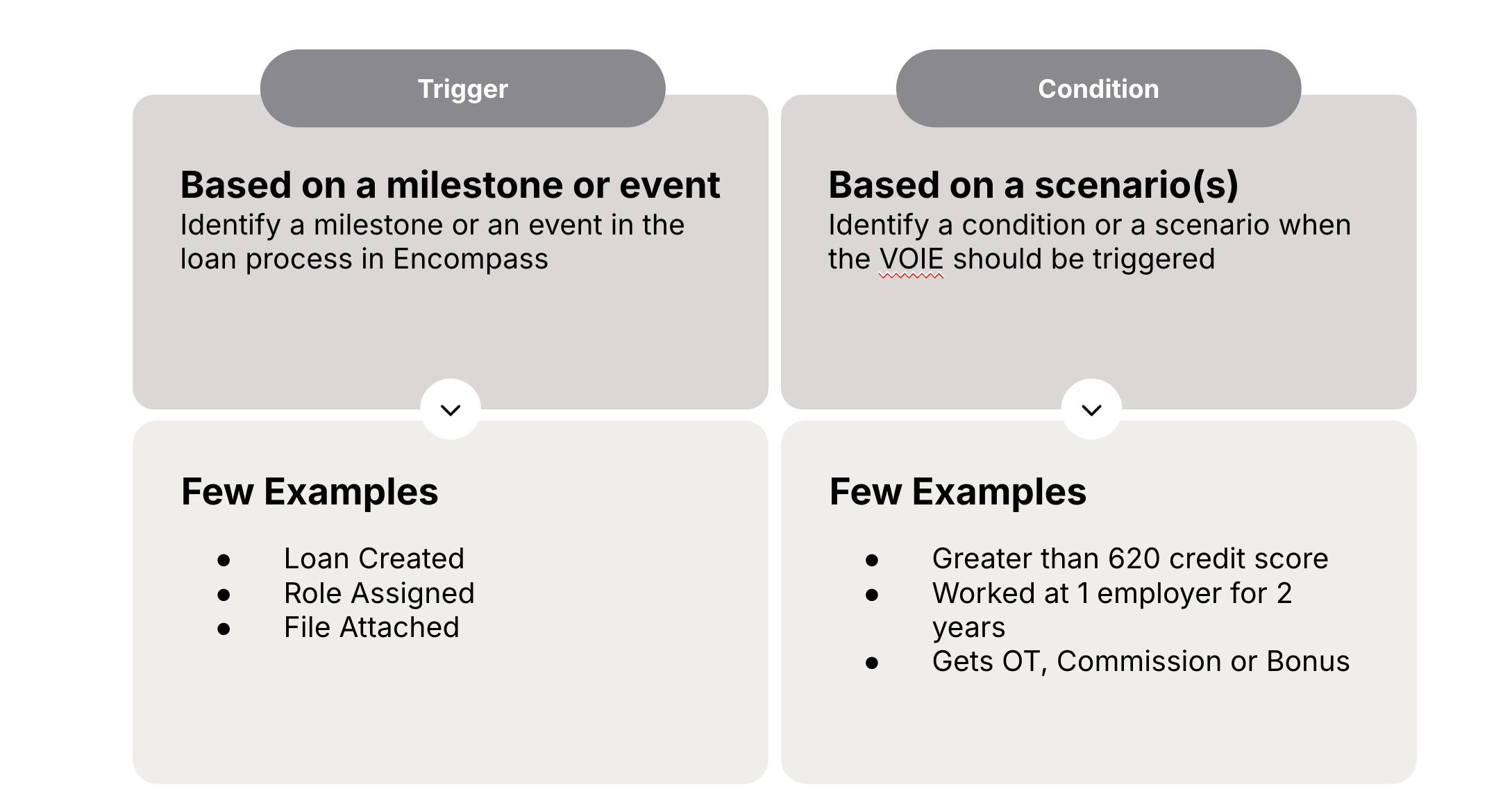

Best Practices for ASO Triggers

ASO can be set up to be triggered in one of the 2-ways

- Milestone or Event based - when an event occurs in the loan process

- Trigger ASO when a role is assigned,

- Trigger ASO when Loan is created,

- Trigger ASO when a file is attached.

- Condition or Scenario based - when a certain condition is met

- All loan applications where borrower lives in

Texas, - All loan applications with greater than 620 credit score,

- All loan applications where borrower worked at the same employer for over 2years.

- All loan applications where borrower lives in

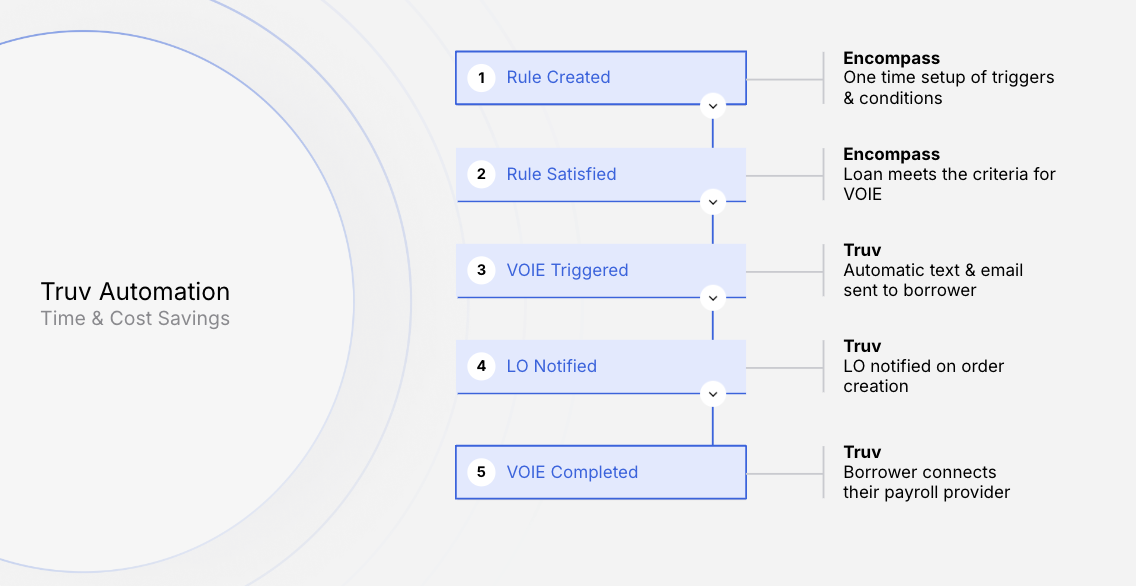

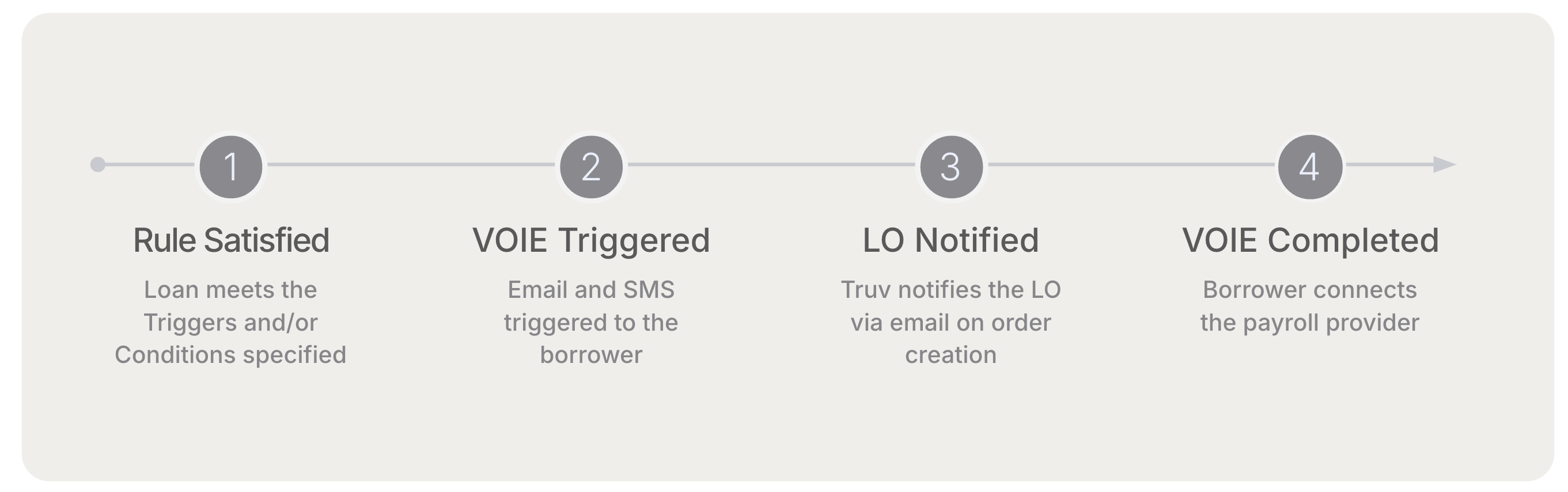

Borrower touchpoints with Truv ASO Automation

Below are the key touchpoints with Truv ASO Automation

Set up Guide (Encompass® Web/LOConnect)

Step1: One-Time Admin Set up:

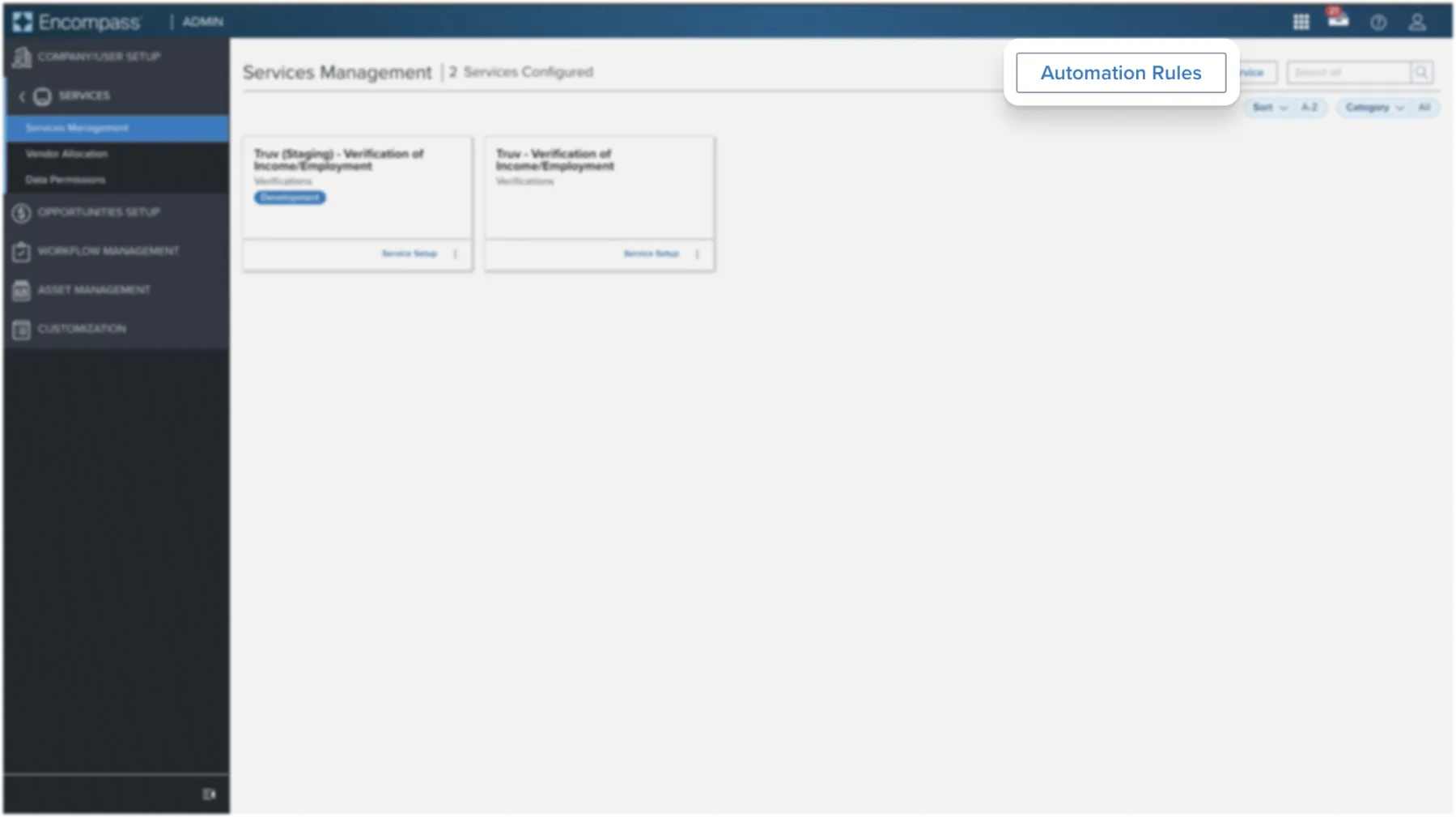

- Log into Encompass® as an administrator using Encompass Web.

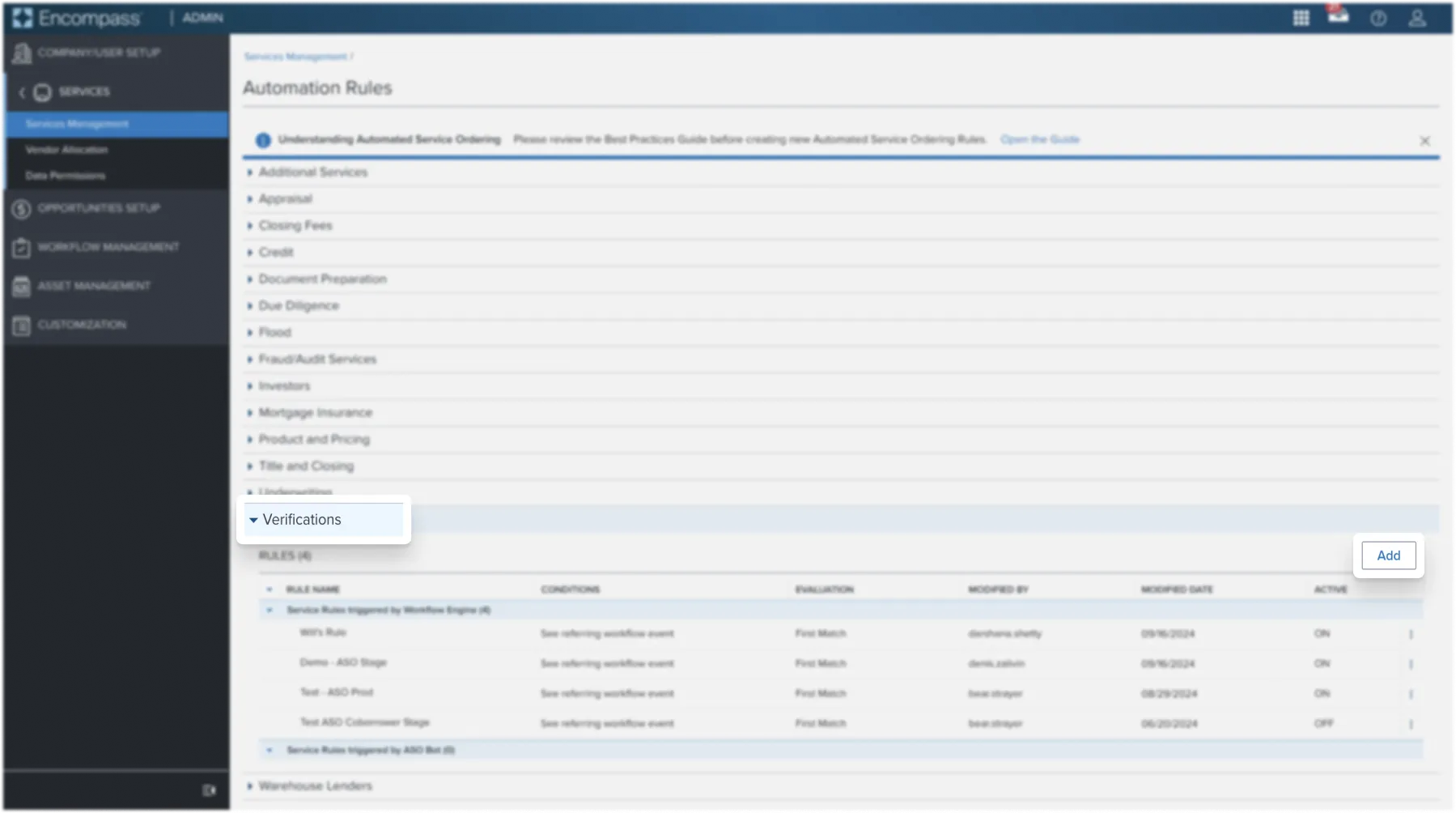

- Navigate to the Admin tab at the top of the screen, select Services on the left navigation.

- Under Services Management, ensure Truv is configured.

- On the top right side of the screen, click the Automation Rules button

- Expand the Verifications category and click the Add button.

This step enables the definition of rules for automated verifications.

NoteEstablish a single rule to trigger Truv automatically. Once the set up is done, this applies to all Borrower and co-borrower pairs within the loan.

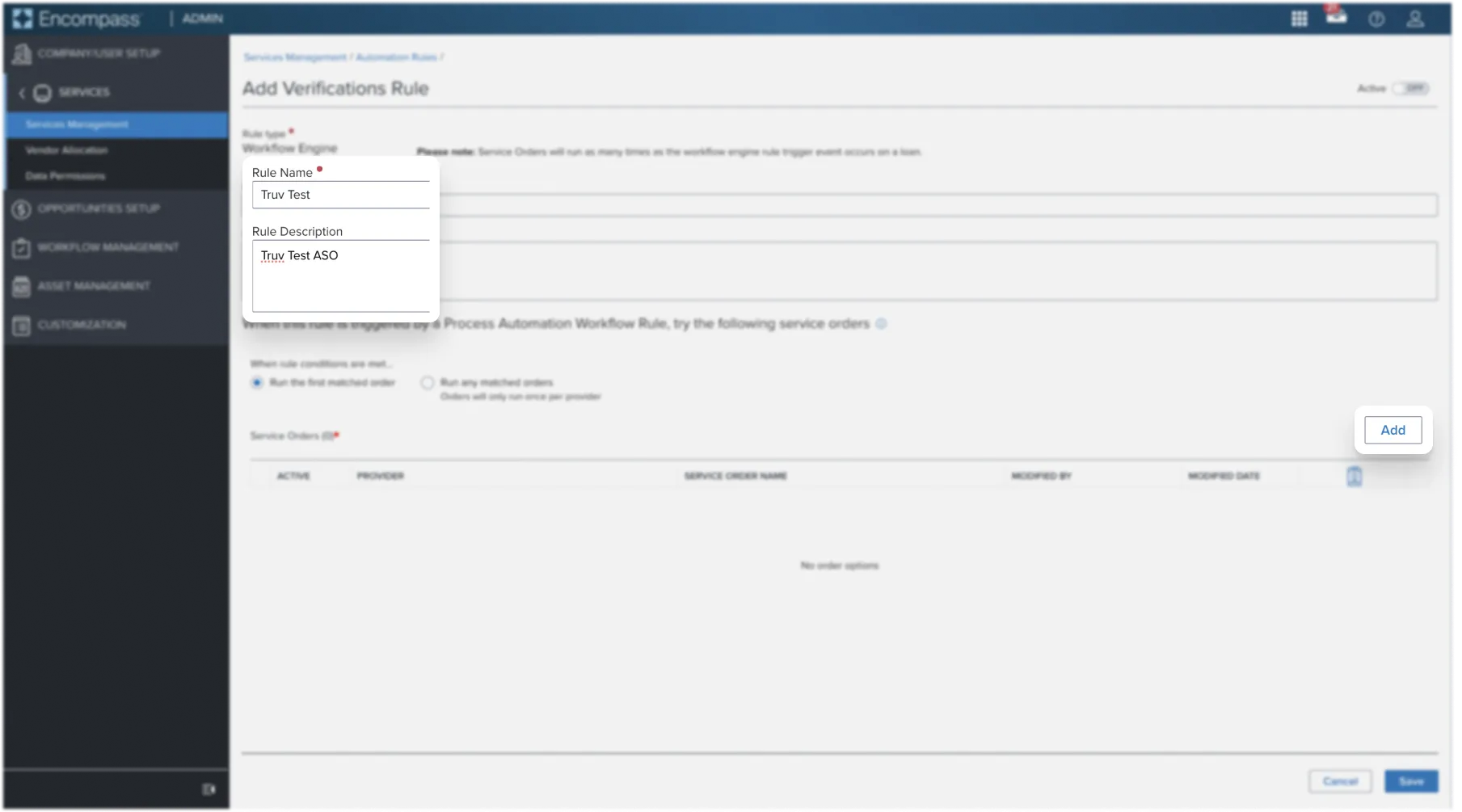

Step 2: Adding a new Rule

The following steps guide the creation of rules for (multiple) employments for both borrowers and co-borrowers.

-

Select the Rule Type as Workflow Engine.

-

Add a Rule Name and Description to uniquely identify your ASO rule.

- NOTE: Conditions for when the Workflow Engine rule should be executed are defined later in the Process Automation tab.

-

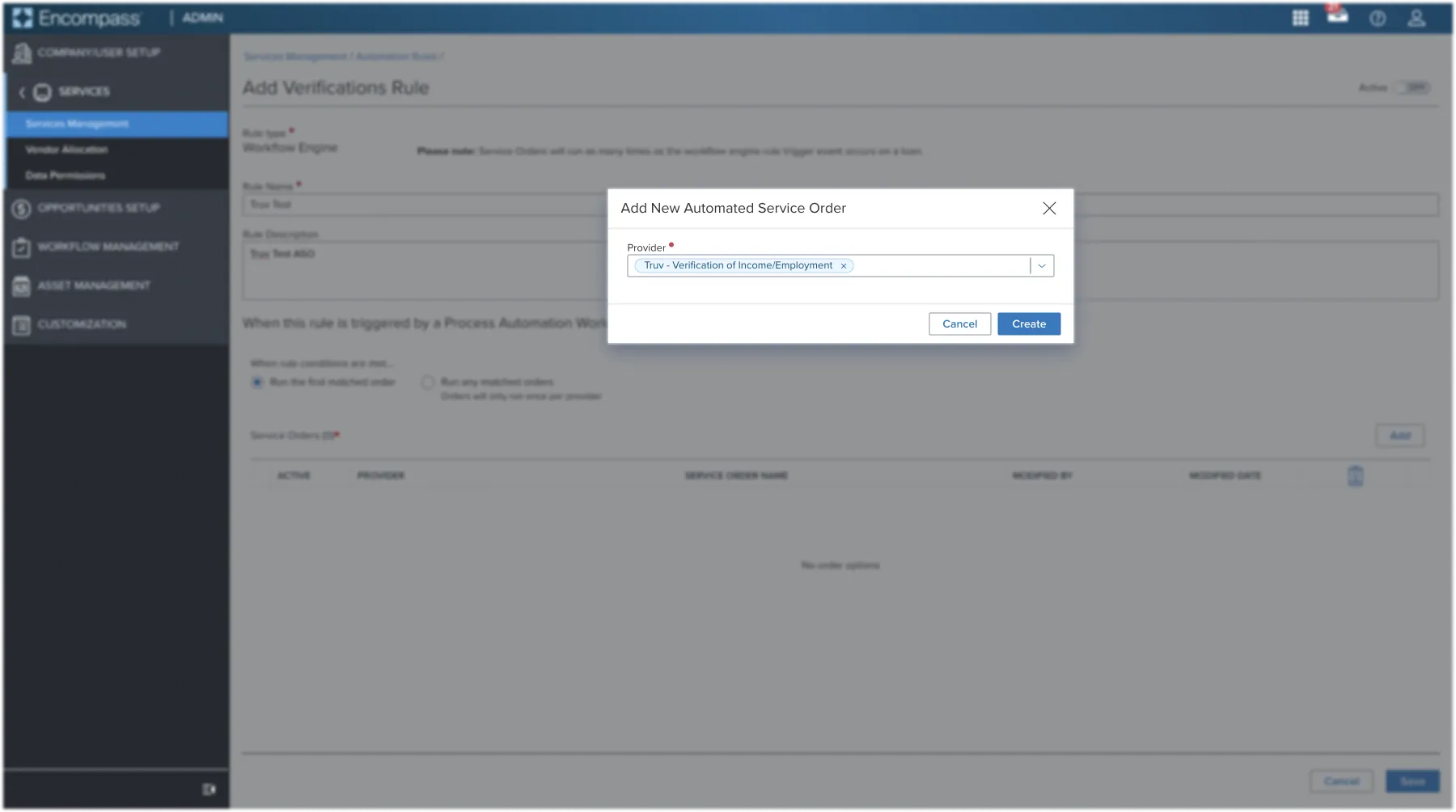

Select the Add button under the Service Order section, then choose Truv as the Provider in the Add New Automated Setup pop-up, and click Create.

Step 3: Adding a Service Order

-

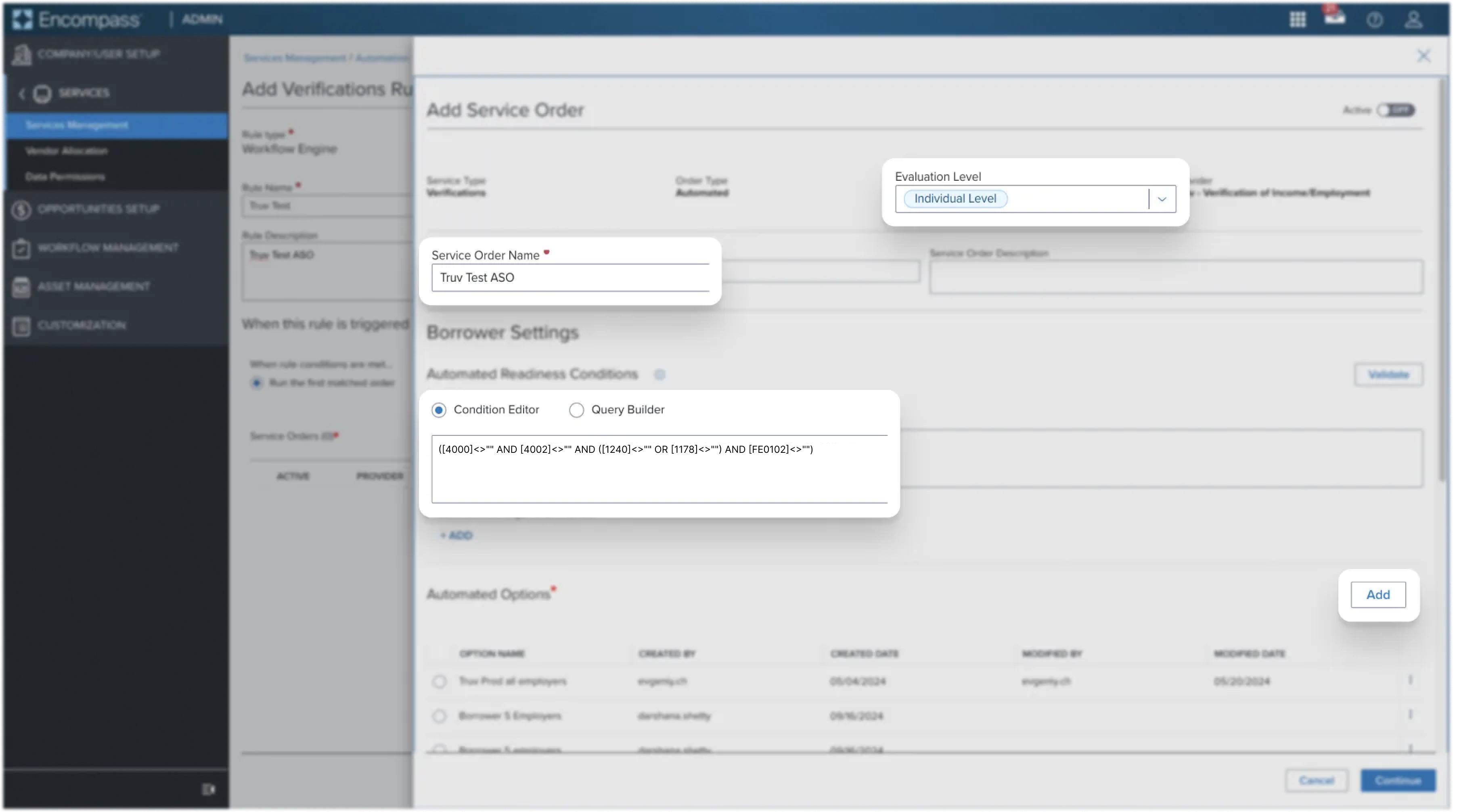

You should see the Add Service Order window open up

- Under Evaluation Level field, select Individual Level

- Enter the Service Order Name and Service Order Description,

- Under Borrower Settings, in Automated Readiness Conditions, pick Condition Editor and paste the below conditions depending on which product type you will be ordering:

- Verification of Income and Employment:

([4000] <> “” AND [4002] <> “” AND ([1240] <> “” OR [1178] <> “”) AND [FE0102] <> "") - Verification of Assets:

([4000] <> “” AND [4002] <> “” AND ([1240] <> “” OR [1178] <> “”))

- Verification of Income and Employment:

- Click on the Add next to Automated Options under Borrower Settings

-

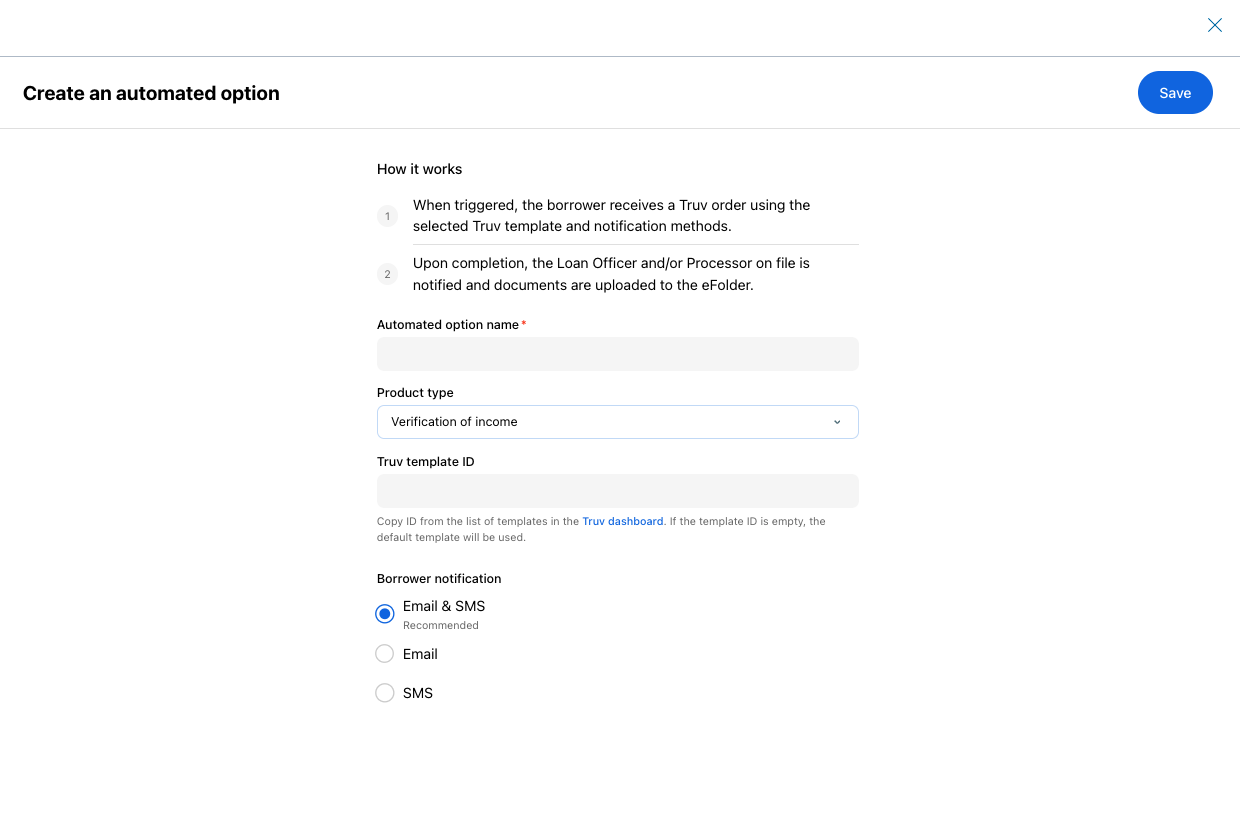

This now opens up the page to create a Truv Automated Option

-

Enter an Automated option name

-

Select the Product type

-

This is the product that will be ordered when automation is triggered with the following options:

- Verification of income

- Verification of employment

- Income Analysis

- Verification of assets

-

Note: the Income Analysis product types is to enable Freddie Mac AIM Check product and requires additional set up

-

-

Add a Truv template ID (optional)

- Navigate to the Truv Dashboard to the Templates tab, copy the desired Template ID and paste it into this field. If no template ID is specified, the automation will use whatever template is present in the Truv Encompass App at the time of triggering.

-

Specify a Borrower notification method

- We recommend selecting Email & SMS, which sees the shortest order completion turnaround time. When the automation triggers, it will try to use whatever Borrower notification methods are selected. If a method is not present, it will be skipped.

-

Press Save

-

-

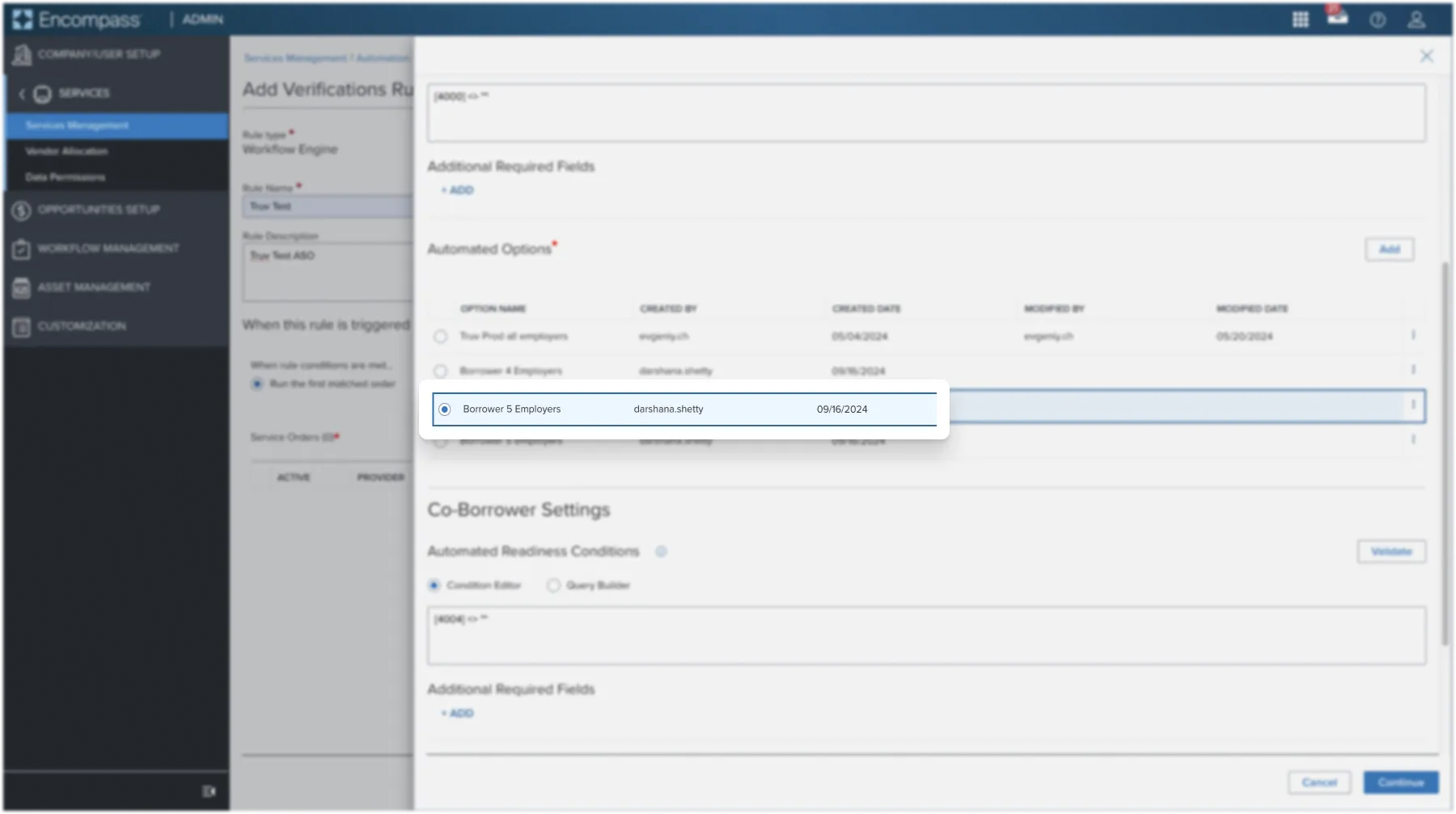

Select the Truv Template in Automated Optionsthat you just created for Borrower

-

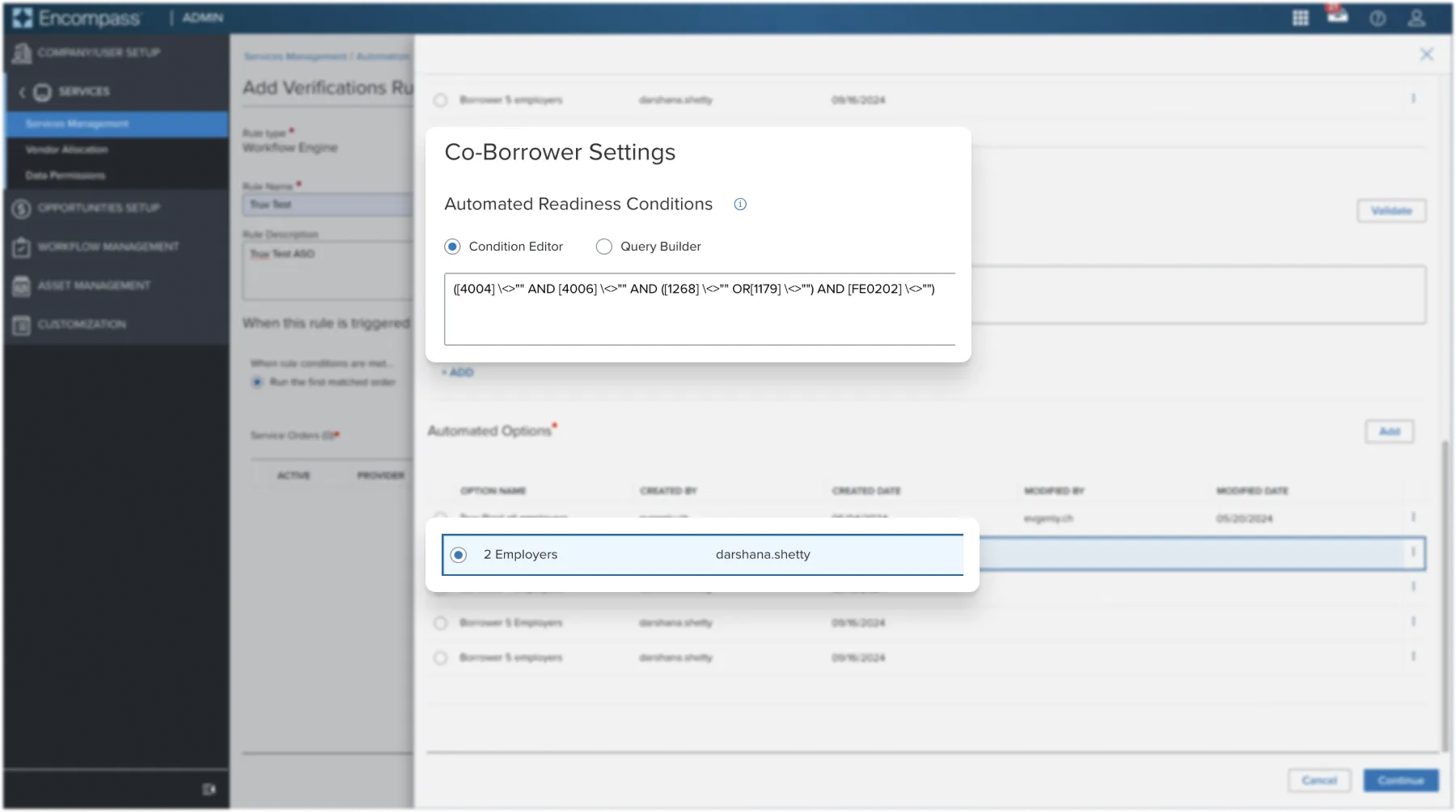

Scroll to the Co-Borrower Settings and repeat Steps 1 - 3 for the Co-Borrower.

-

Please NOTE the Condition Editor query for the Co-Borrower is different from the Borrower

- Verification of Income and Employment:

([4004] <> “” AND [4006] <> “” AND ([1268] <> “” OR [1179] <> “”) AND [FE0202] <> "") - Verification of Assets:

([4004] <> “” AND [4006] <> “” AND ([1268] <> “” OR [1179] <> “”))

- Verification of Income and Employment:

-

You can skip Step 2 if you plan to use the same template for the Borrower and Co-Borrower, but you'll still need to select the template for the Co-Borrower in the corresponding Automated Options

-

If you want to create a different template, see Step 2 and select that template for the Co-Borrower

- Click on the Continue button at the right bottom corner to proceed after selecting the template for both the Borrower and Co-borrower.

- Ensure you see Truv with the newly created Service order under the Service Order

- As a final step ensure you have the Service order as Active and click on the Save button

Step 4: Creating Workflow Rules

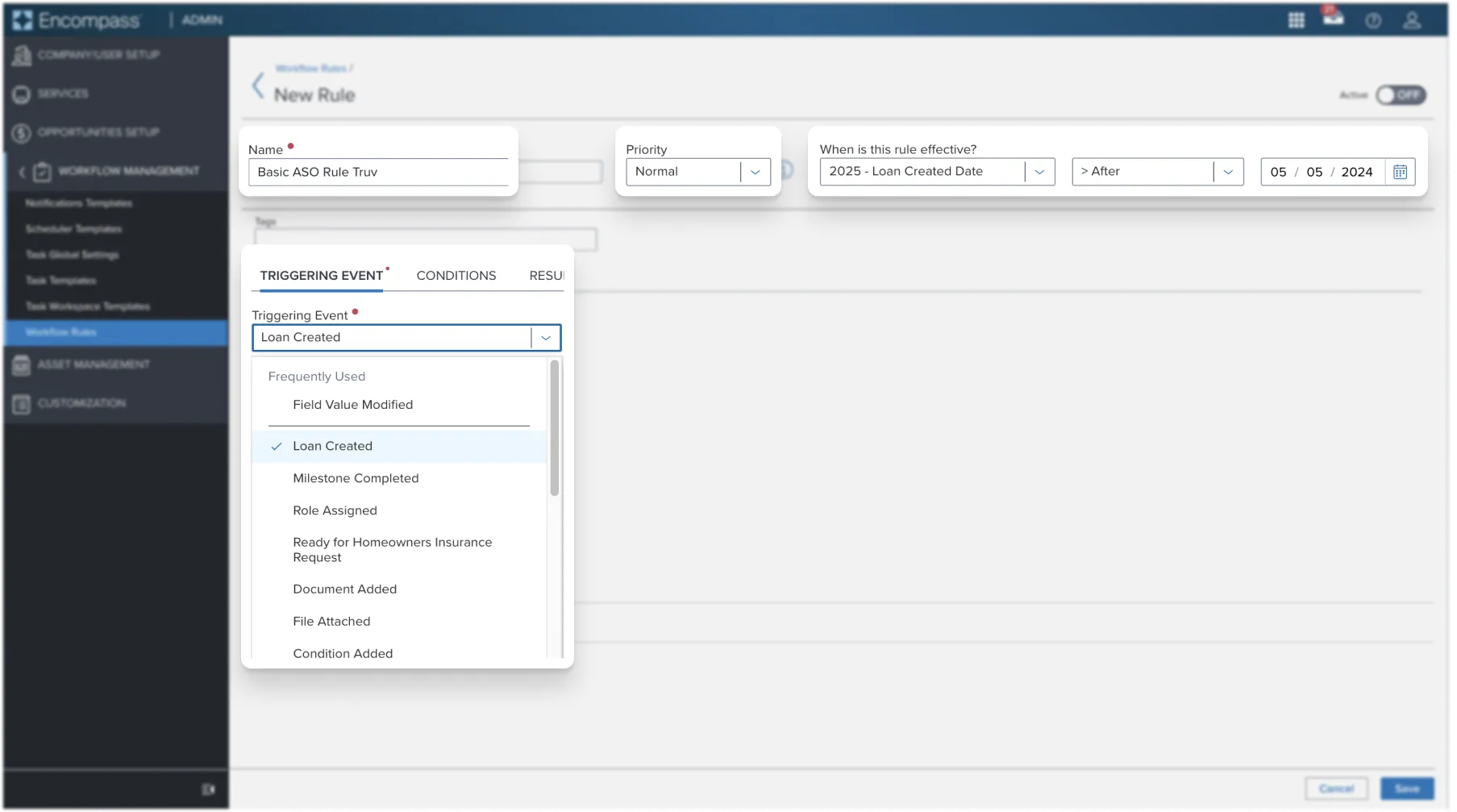

Create a Workflow Rule to set when an automated Truv order should be placed.

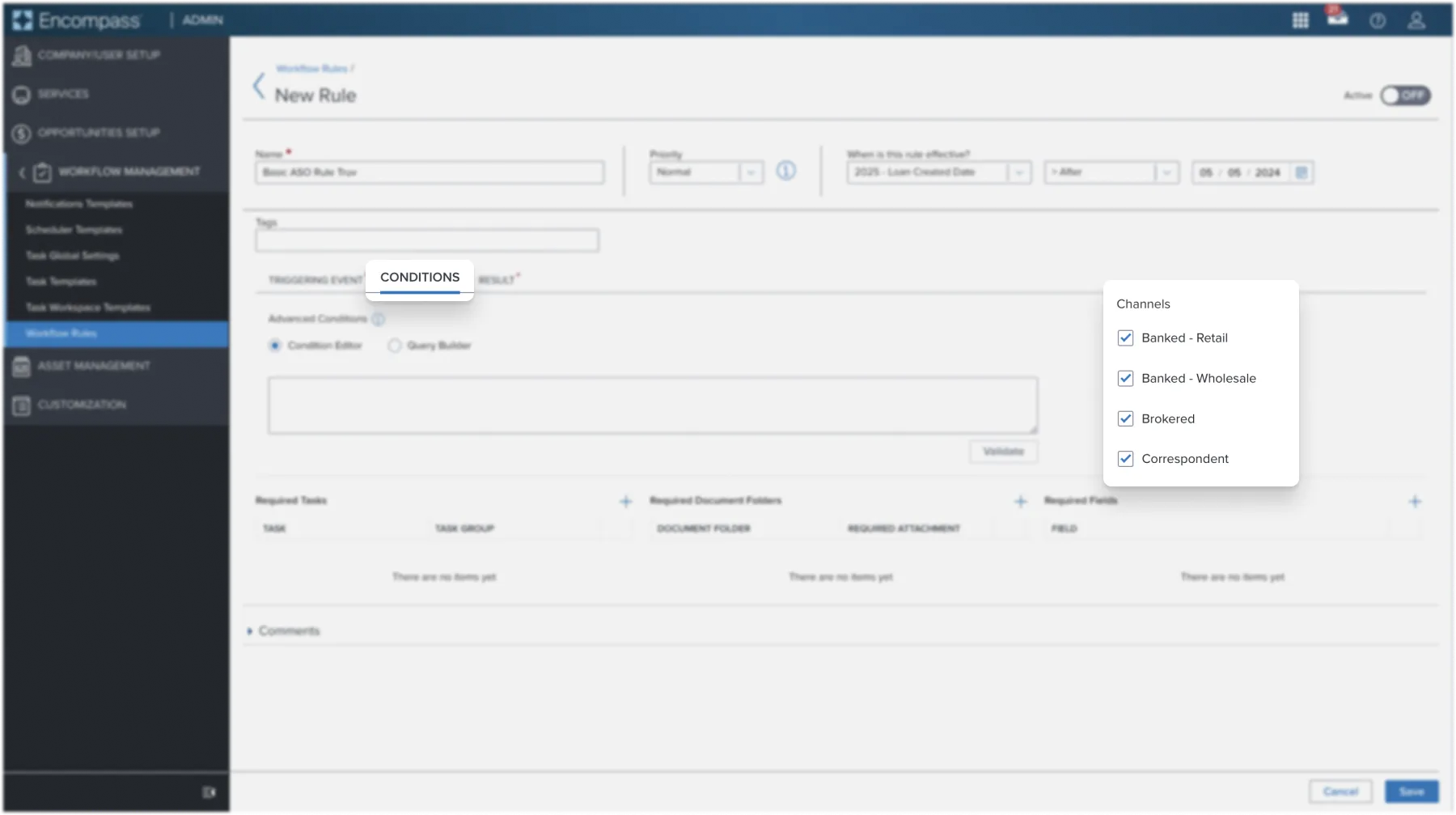

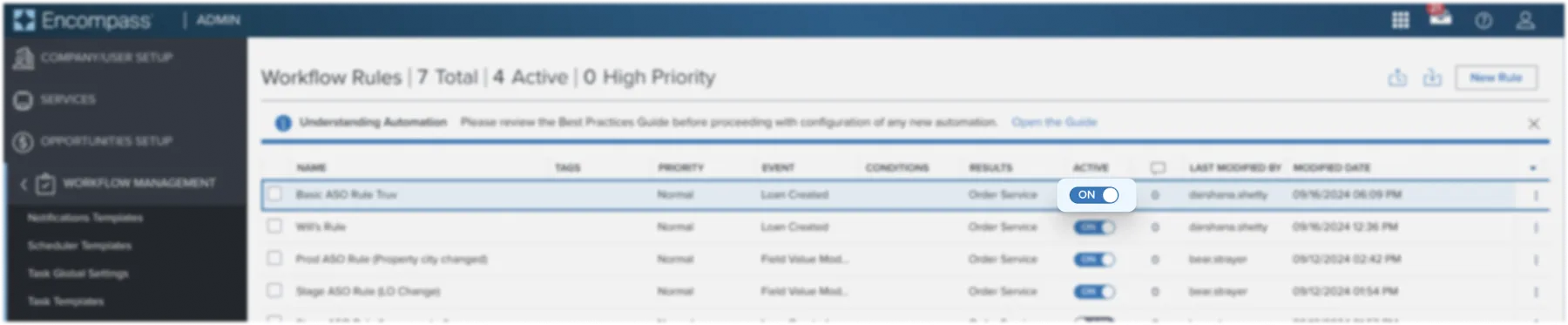

- Go to the Workflow Rules tab under Process Automation in Encompass Admin, then select New Rule

- Add the Rule Name, Rule Effective Date, Triggering Event, and Conditions

- The Rule Effective Date allows you to specify loan or application cutoff dates when this rule should apply

- The Triggering Event determines when this rule will run.

- For example, if Triggering Event is Loan Created, it will attempt to run the rule at Loan Creation

- For example, if Triggering Event is Field Value Modified - Field ID 317 - Any Change, it will attempt to run the rule anytime there is a change to Field 317 (LO Name)

- If there are Conditions set, it will evaluate against those to decide if it should execute or not.

- Conditions allow users to specify more granular scenarios where the rule should execute. In addition to the conditions, select any loan Channels where this rule should apply.

- By combining the right Triggering Event and Conditions, users can set up advanced scenarios for when to automatically order Truv.

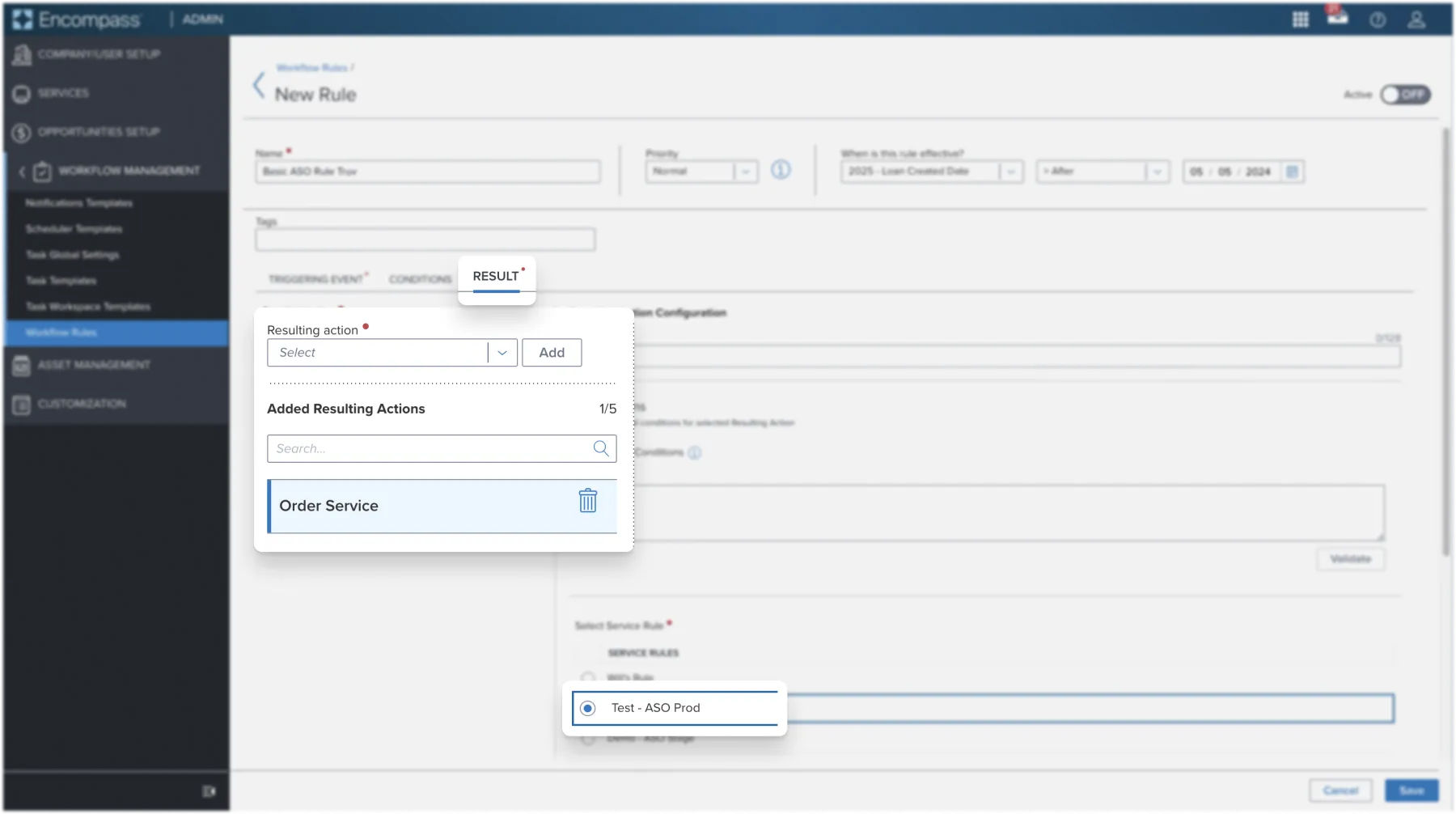

- Set the Result action

- Under Resulting action search and select Order Service

- Select the Service Order we set up earlier in the guide and Save

- Ensure your rule has Active mode switched ON

NotePlease ensure that each Rule is enabled by setting the Active mode to ON.

If you are using Encompass® SmartClient, please ensure to get out of the loan for ASO to work. If you are in the loan while trying to automatically trigger Truv, the order creation fails and has to be manually created.

Encompass® ASO Set up Walkthrough

For a quick overview of the Truv ASO Set up Guide within Encompass® workflow, watch the video below.

Conclusion

The automatic triggering of Truv Orders within Encompass® is a game-changer for mortgage professionals seeking to optimize their workflow. By leveraging this integration, lenders can achieve remarkable time savings, enhance borrower satisfaction, and accelerate loan processing. As the mortgage industry continues to evolve, embracing automated solutions like this not only meets current demands but also sets the stage for a more efficient and competitive future.

For further assistance, please reach out to [email protected] or your Customer Success Manager.

Updated 16 days ago