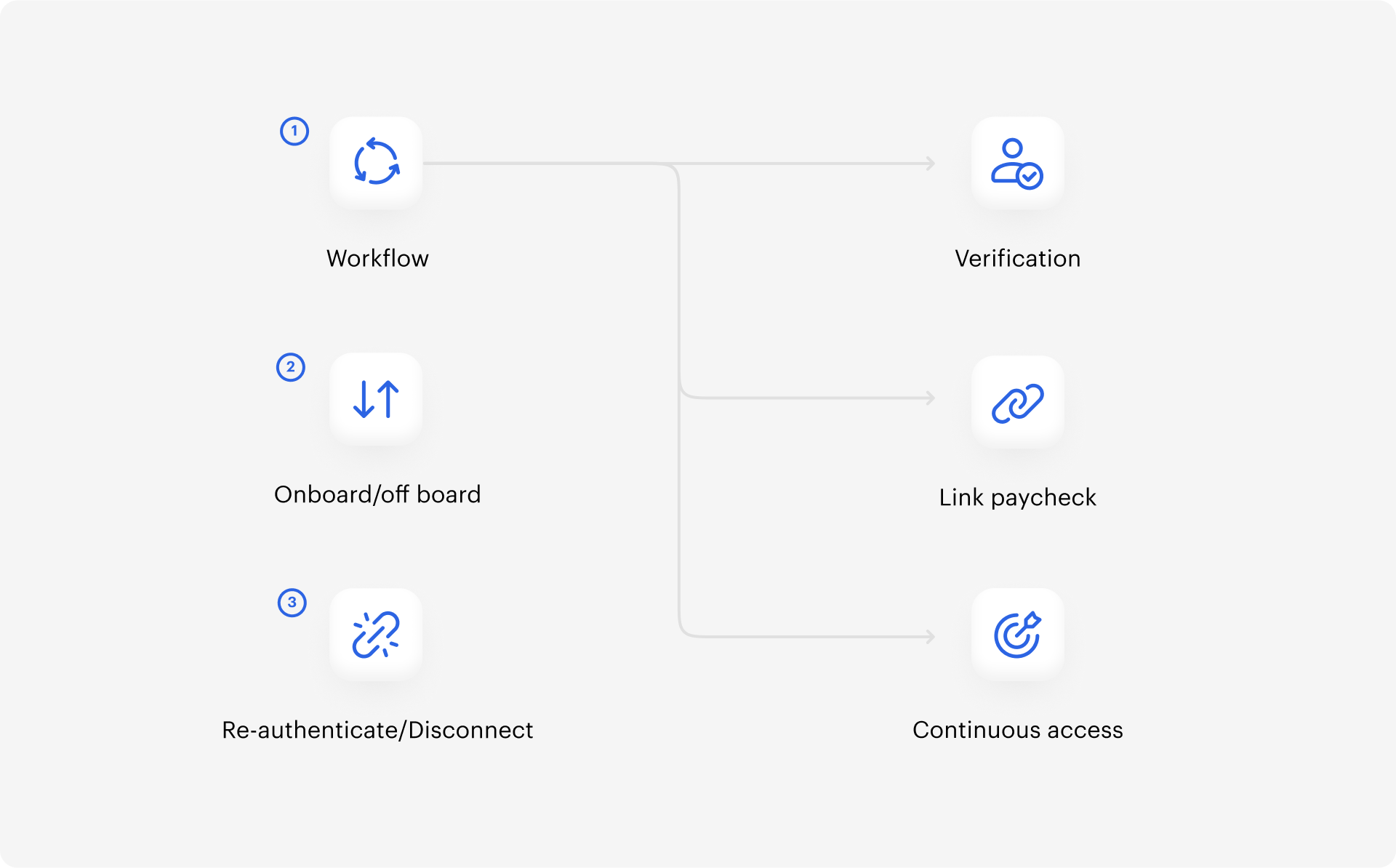

Scoping Paycheck Linked Lending for your Workflow

Learn about integrating Truv Paycheck Linked Lending into your User Experience with effective design and planning.

Evaluate your current process

Truv retrieves all employment data related to a payroll account. You can then use that data throughout your application process.

- After Verification of Income and Employment - After verifying income and employment, have users decide and allocate part of their paycheck from their payroll.

- Continuous access - Use Truv for consistent access to payroll and employment data. This makes it simpler to automatically update your system.

User onboarding and off-boarding

Our intuitive user interface and user experience improves conversion rates compared to traditional methods. Your user experience is more successful when connecting to your user’s payroll with a streamlined setup. Establish a simple and straightforward process with these benefits.

You can also let users manage their account. With this option, they can disconnect and delete data from the system as needed.

Continuous access for most recent user data

Truv's platform can notify your system when proactively pulling income and employment data. Receive notifications when any user information changes, such as a new paystub or employment status.

For example, when connections to a specific session expires, you can set up a user workflow to return to the application. This lets users re-authenticate with Truv Bridge and connect again, depending on the payroll system.

Updated 7 months ago