Encompass® by ICE Mortgage Technology®

Verify income and employment using Truv within the Encompass® by ICE Mortgage Technology® platform.

Overview

Verify income, employment and assets within the Encompass® Partner Connect platform by ICE Mortgage Technology® platform. Truv is available in both Encompass® SmartClient and Encompass® LO Connect/Web.

Key Benefits

- Leverage Truv products out-of-the-box.

- Go live in days, no implementation required.

- White label and customize Truv workflow with templates.

- Minimize change management.

- Gather all required data and documentation within Encompass® to accelerate loan process.

How it works

- Invites are sent to borrowers/co-borrowers to share their income, employment and asset information by connecting their payroll accounts or financial institutions using Truv.

- Once borrower connects their accounts, Truv reports are made available in the Encompass® eFolder along with relevant payroll documents as set up by your Encompass® admin (paystubs, W2, borrower reports - submitted to GSE's, employer level reports and order invoices)

- Connected accounts are monitored for new payroll documents, and new verification reports can be continuously generated throughout the mortgage loan origination process.

Encompass® Admin setup

Follow the step-by-step detailed Encompass® set up guide for utilizing Truv within the Encompass® platform. To begin with the setup, first choose the workflow that fits the needs of your organization. You have the option to choose from:

- Automated Service Ordering (ASO) within Encompass®

- Manual Ordering within Encompass®

1. Encompass® Automated Service Ordering (ASO)

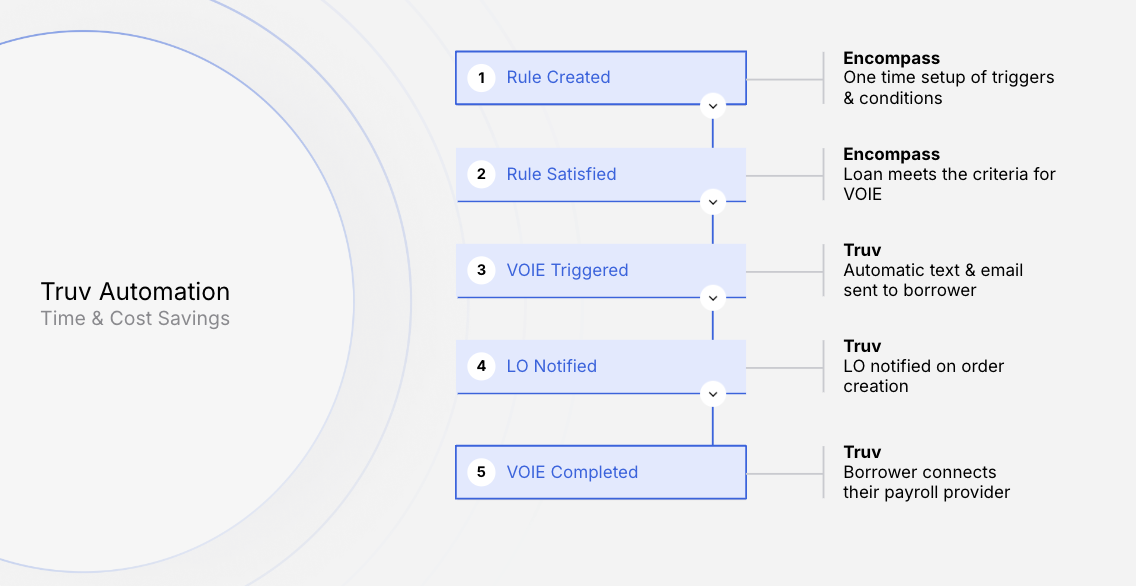

Encompass® (desktop and web editions) offers support for automatic service orders (ASO) when a loan fulfills certain conditions. This is referred to as Automated Service Ordering or ASO. Any Encompass® Partner Connect, EPC integration can be configured by a lender administrator to submit automated orders. This powerful feature is designed to reduce the manual workload for lenders' personnel.

Loans that do not meet the ASO conditions or criteria are automatically placed in Manual orders for loan personnel to review and place orders manually.

Refer to the detailed step-by-step ASO guide for configuring one time setup for Automated Service Ordering (ASO).

2. Encompass® Manual set up

With manual orders, leverage Truv UI within the Encompass® platform to place income, employment and asset verifications.

Refer to the detailed step-by-step Manual guide for configuring Truv Manual ordering within Encompass®.

NOTETruv recommends the use of Automated Service Ordering(ASO) to help lenders optimize resources, reduce costs and increase underwriting efficiency.

ASO is a one-time set up to further help eliminate duplicate orders and unnecessary verification orders.

Truv Coverage in Encompass

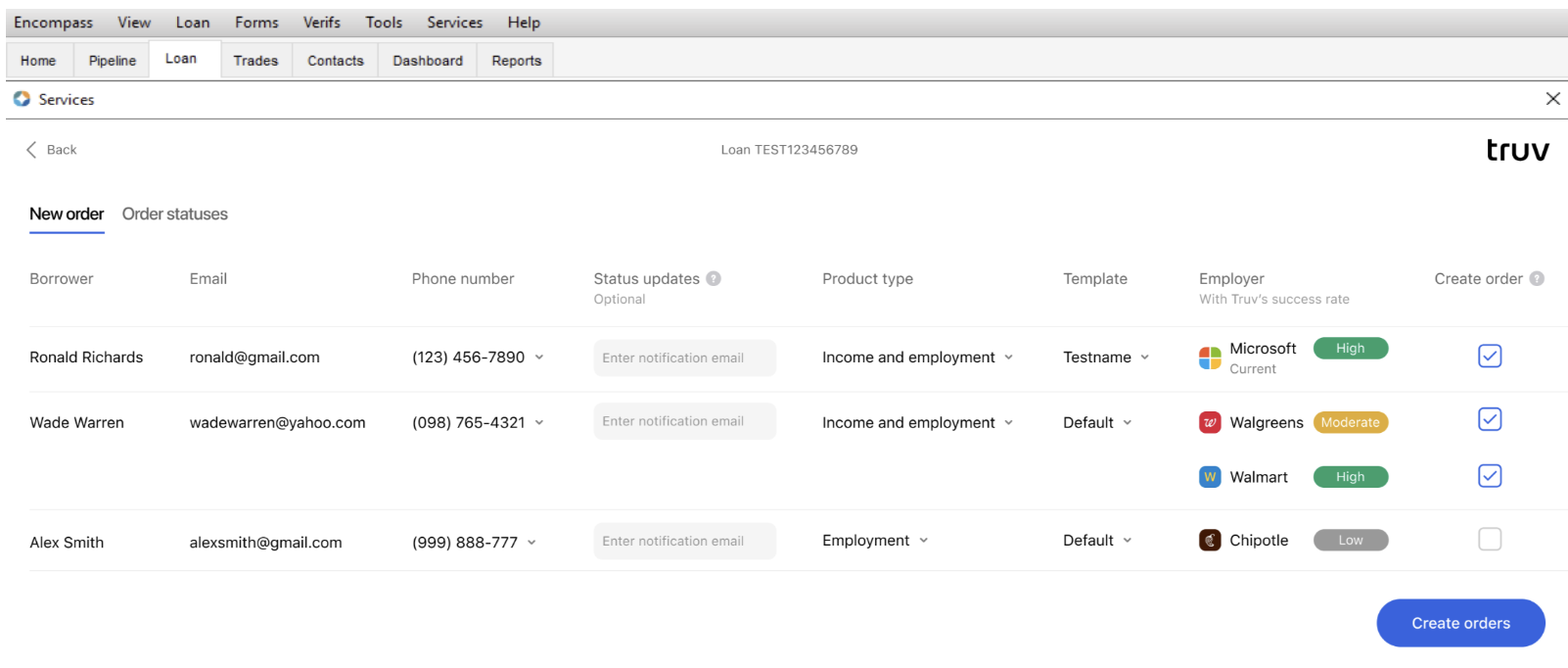

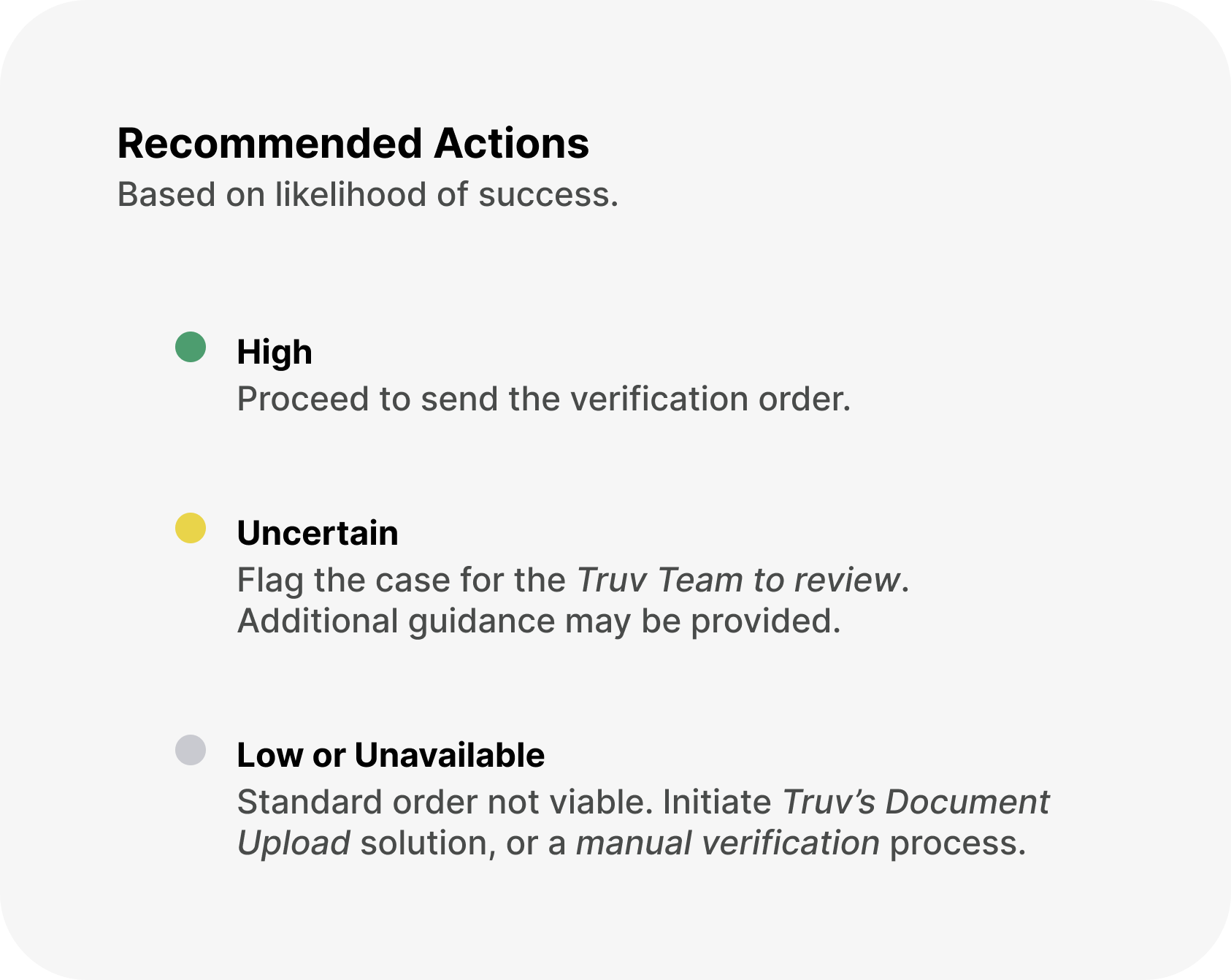

Truv guides loan personnel to streamline the income and employment verification with insights on Truv coverage within Encompass® platform. The coverage is an employer level indication and provides a likelihood of success with Truv within Encompass®.

Truv Customization

Truv allows clients to completely white label their experience

- White labeling using Truv Templates

- Set up templates in Truv Dashboard to white label and customize the Encompass® experience weather its relevant to your business subsidiary or branches. This is a one time set up and can be used to customize your Branding, Notifications, Documents Returned, Fallback options, Truv Bridge.

- Encompass® Status updates customization

- Truv allows to customize who receives updates on the loan application every step of the way. Encompass® lenders have an option to configure who receives status notifications and updates on every loan.

- Encompass® eFolder (Document Mapping)

- Take control of your Encompass® eFolder experience and customize who can view various documents retrieved in your organization with Document Mapping functionality within Encompass®.

Refer to the detailed step-by-step Encompass customization guide for configuring one time setup for Truv Manual ordering within Encompass®.

Verifying Income and Employment (VOIE) with Truv

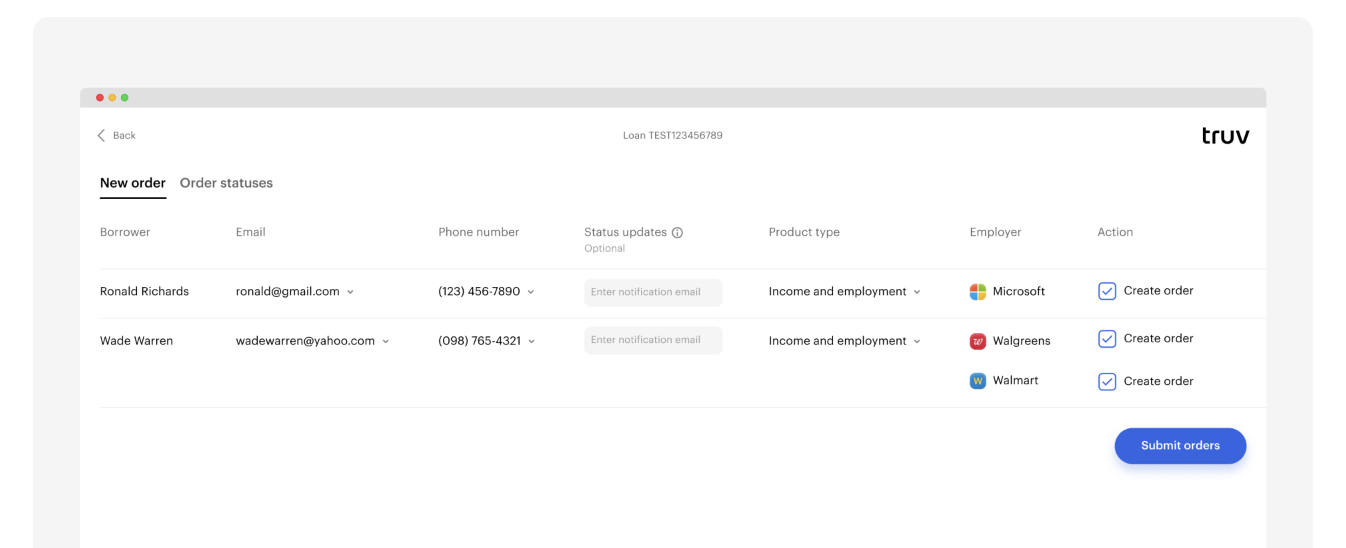

Once your one-time set up is completed, you can select a loan application and order from Truv in the New Order tab. Truv automatically pulls all the employers listed in the loan application so your team can order Income and Employment verifications.

Refer to the detailed step-by-step Encompass Ordering a verification guide for configuring one time setup for Truv Manual ordering within Encompass®.

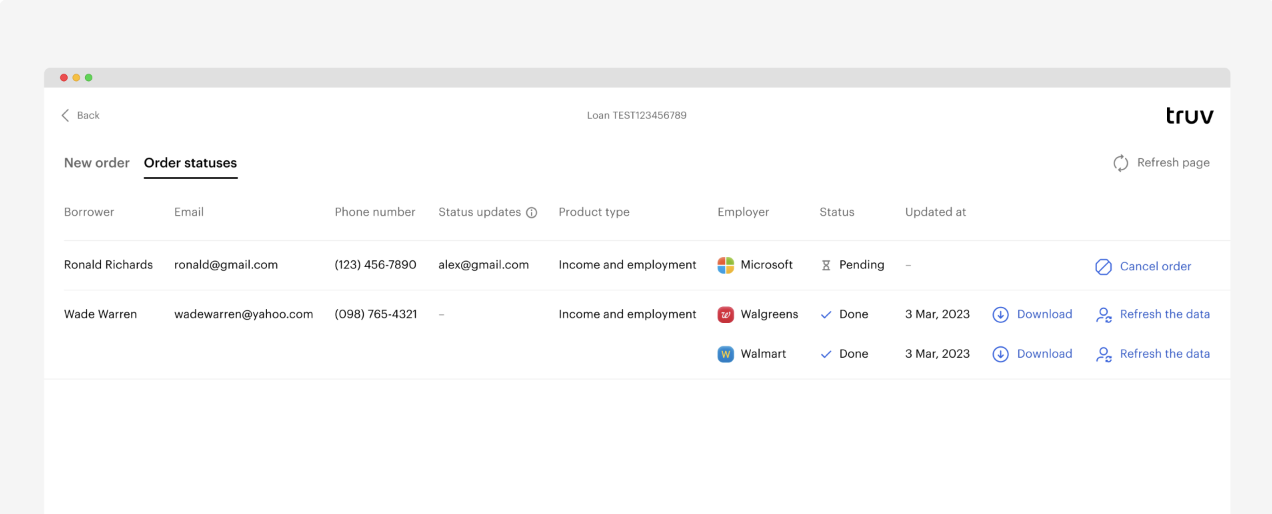

Re-verification with Truv within Encompass®

Truv provides you with the optionality to re-verify or refresh the data.

- Navigate to the Truv Instance within Encompass®.

- Once you have selected the loan select the order that you wish to re-verify.

- Click on

Refresh the datato proceed with the re-verification.- Truv always does a backend refresh to pull the request verification.

- In some cases, Truv needs borrower to re-authenticate. In such cases, Truv notifies the borrower to re-authenticate into the specified employers.

- While ordering a re-verification you have the option to select a Employment only verification for the 10-day PCV or request a full Income and Employment re-verification.

- Truv also provides the optionality for your teams to select from current and prior employments for the borrower or co-borrower.

- All of the returned documents are automatically uploaded to the Encompass® eFolder based on your configurations.

Fannie Mae D1Certainty and Freddie Mac AIM Submissions

Follow the steps outlined below to submit to Day 1 Certainty® or AIM through Encompass®:

- Select Truv Borrower Report that has been generated

- The Report ID from Truv's Borrower report will already be auto-populated in the Truv field.

- Truv generates a new report and an associated

Report IDin the Truv's Borrower report on every re-verification which is auto-populated in the Truv Fannie Mae and Freddie Mac fields. - If for some reason the

Report IDis not auto-populated, copy and paste the Reference # from Truv Borrower report into the Truv field. - If a borrower and co-borrower are being submitted, their respective

Report IDone after the other, separated by a comma with no space.

Refer to the detailed step-by-step guide to submit to GSE's for Truv within Encompass®.

Overview of Truv within Encompass®

Quick overview of Truv within ICE Encompass®.

For further assistance, please reach out to [email protected] or your Customer Success Manager.

Updated 7 months ago