Integrations for Verifying Income and Employment

Use the integrations in this guide for additional VOIE methods and strategies.

Overview

VOIE from Truv provides additional options for your users' data. The integrations below bring important financial information through your workflow. View more details about the integrations and use cases in the table below.

Integration | Description | Possible use cases |

|---|---|---|

Collect user documents to process and analyze data |

| |

Connect tax preparation providers to income and employment verification |

| |

Use digital records from financial institutions for user income stream insights |

| |

Use verification of income and employment and share reports with government sponsored enterprises |

|

Process for integrations

The points below cover getting started with the VOIE integration methods. The items below cover the general process. Follow the relevant sections to continue with your use case needs.

- Configuring your integration - Planning your use case contexts and needs for configuration

- Bridge Token specifications- Setting up Truv Bridge and the required tokens

- Testing integrations- Testing your integration with sample credentials and values

Configuring your integration

Each of the integrations for these verification methods has the sections below help to get started. View the configurations in the sections below, then proceed to setting up Truv Bridge. When creating a bridge_token, the integrations have separate values to include for your configuration.

The sections below cover the specifications for each of the integrations when planning out the use case workflow. View the samples in the Bridge Token specifications section for more.

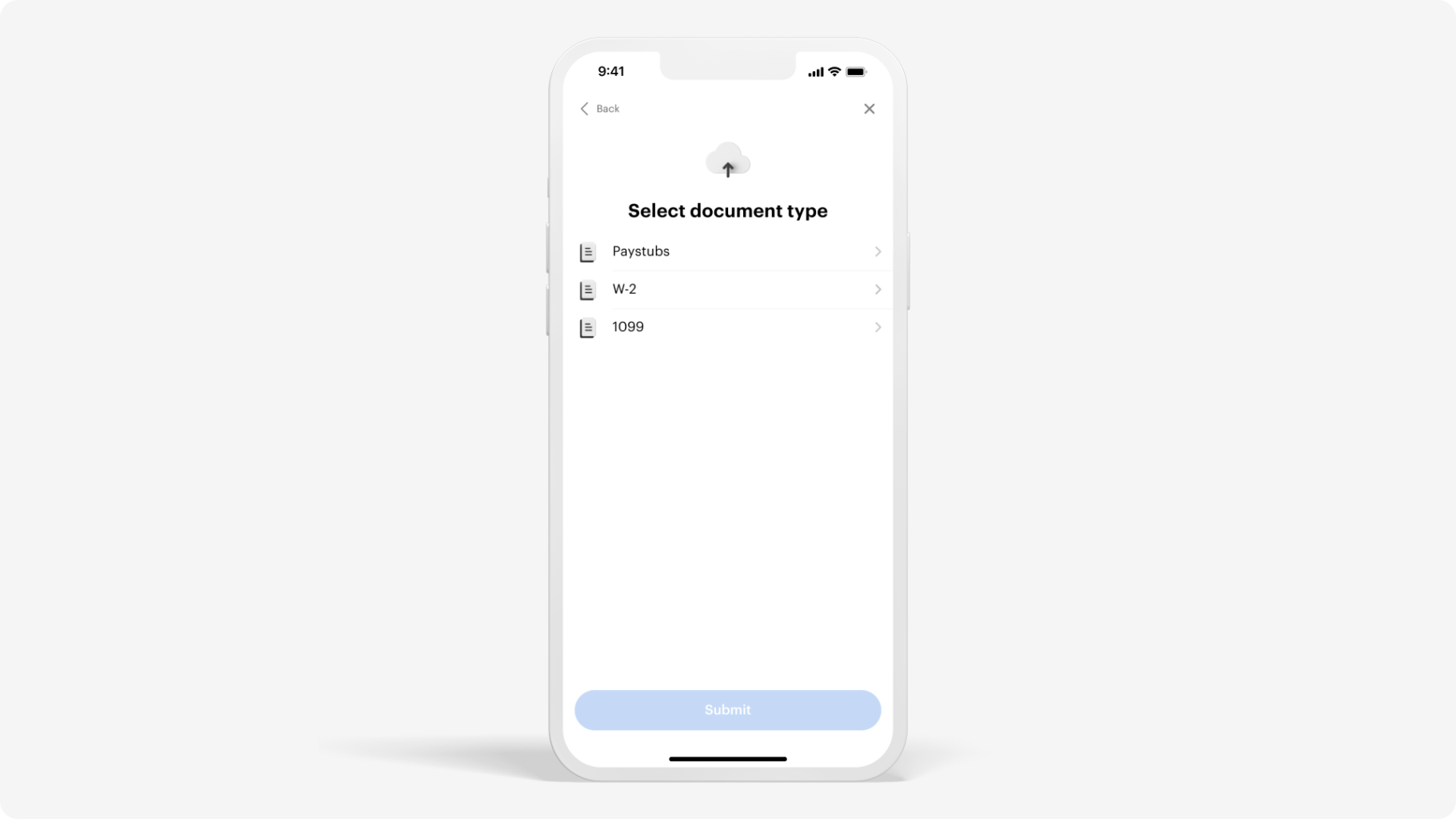

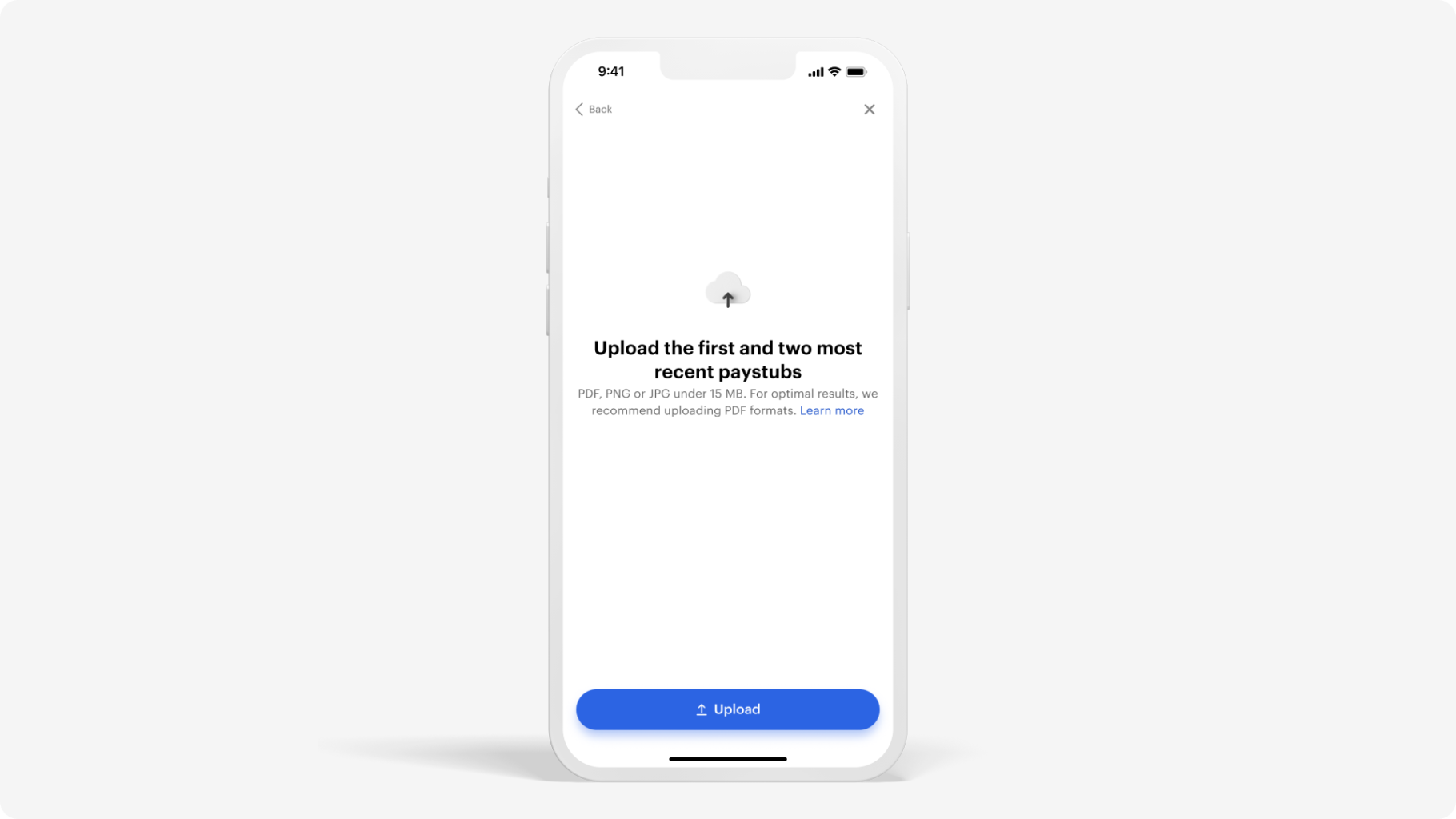

Document processing

Truv's document processing solution helps you collect user documents. These files are then processed to extract structured data and analysed for fraud. The points below cover user information to collect when integrating your document processing solution.

- Document type required, such as

paystubs,W2, and1099

NoteFor 1099 tax documents, Truv supports parsing for formatting from any year after 2021. This includes the following 1099 forms.

- 1099-DIV, 1099-G, 1099-INT, 1099-MISC, 1099-NEC, 1099-R

- Number of documents required for each type

- Applicant

first_nameandlast_name

In addition, you can add a specific message for your users displayed in Truv Bridge. Use Customization Templates to start with configurations for your users.

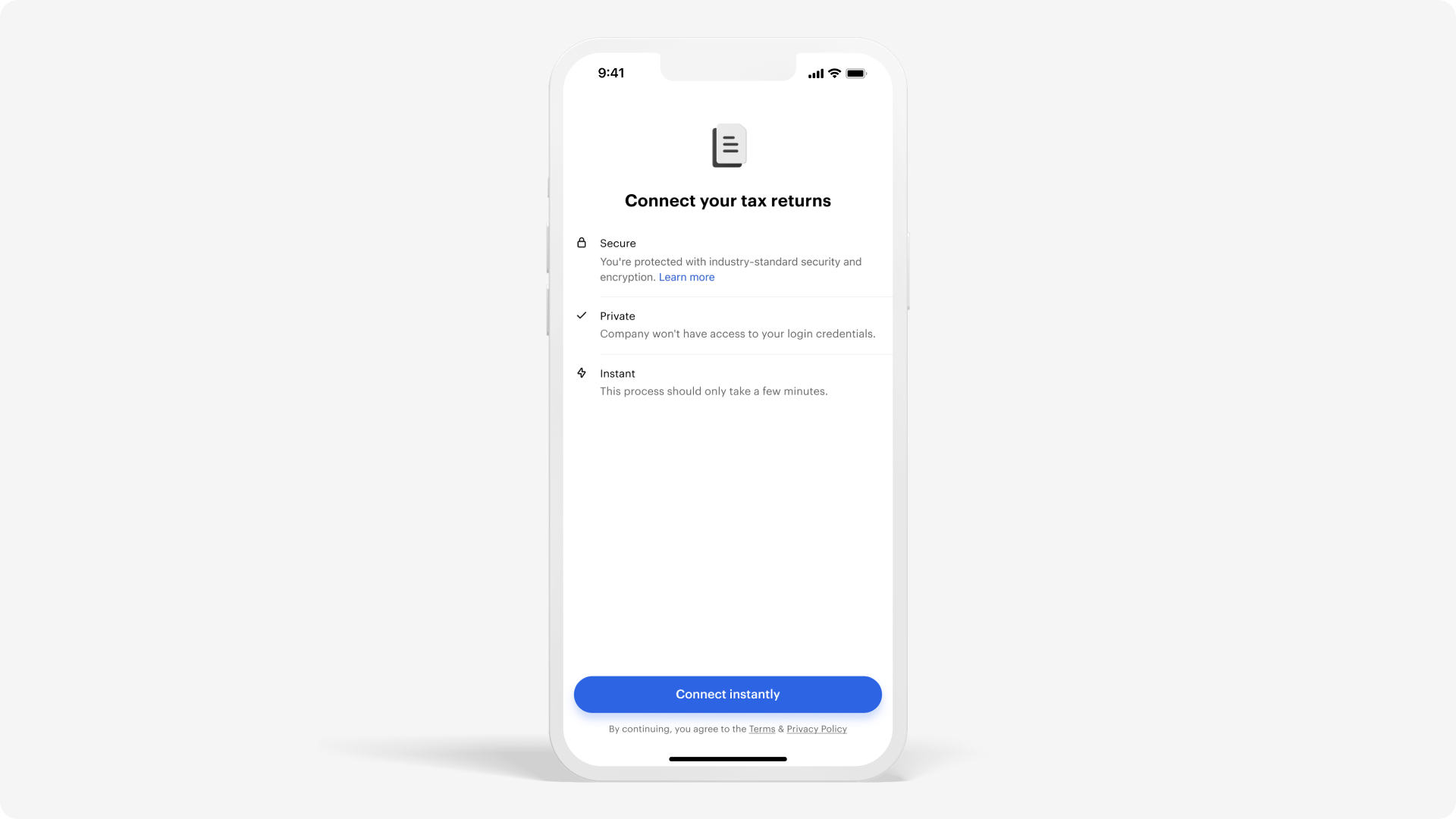

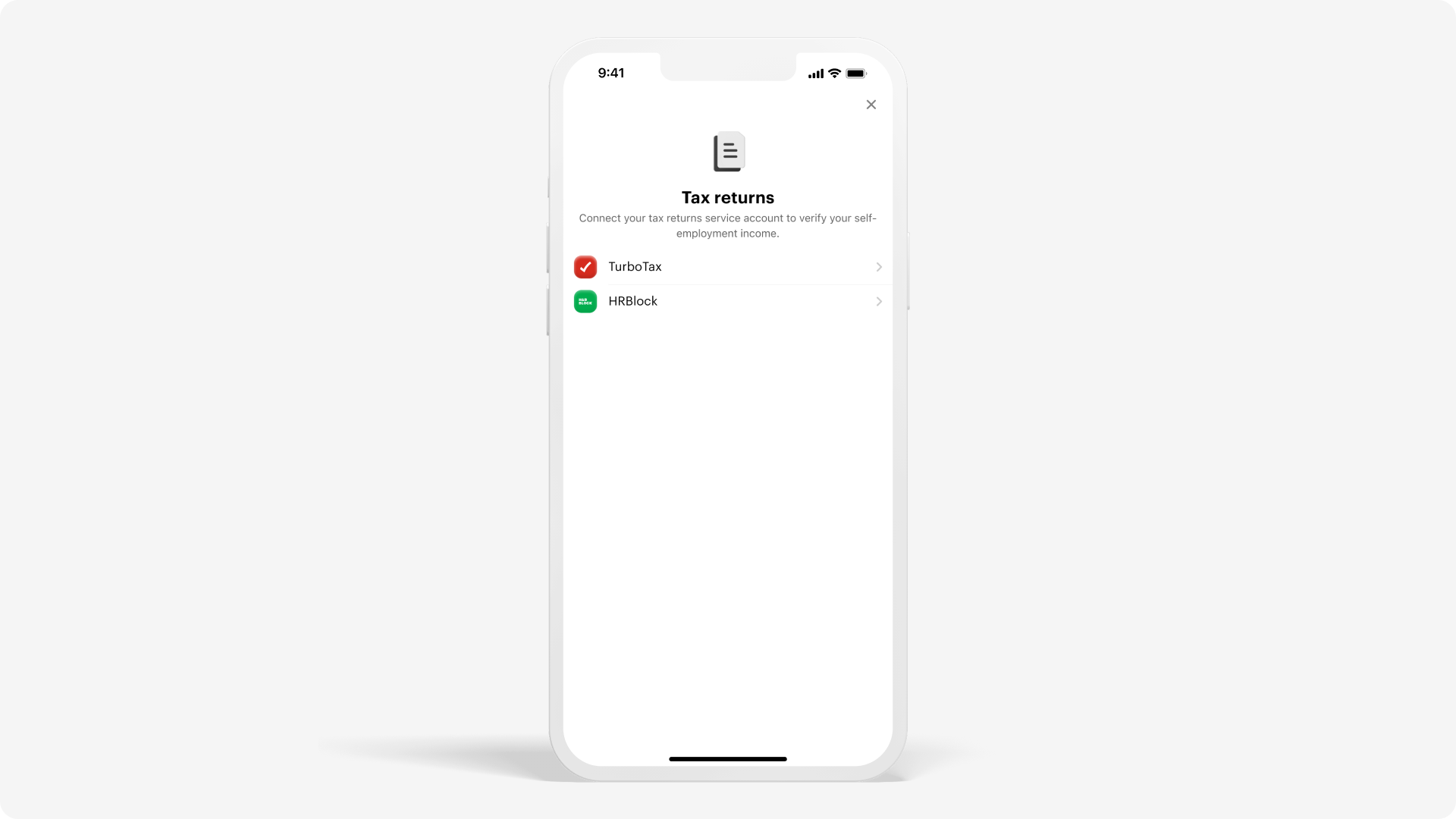

Tax return collection

Truv simplifies connecting your users to their tax preparation software providers. Configure your introduction page to your users on top of Truv’s widget templates.

Users can then verify income and connect to their tax preparation software from the start. Verification can be instant compared to the wait time for IRS tax returns and documents such as 4506-C. Users can select their tax preparation provider from the list in Truv Bridge.

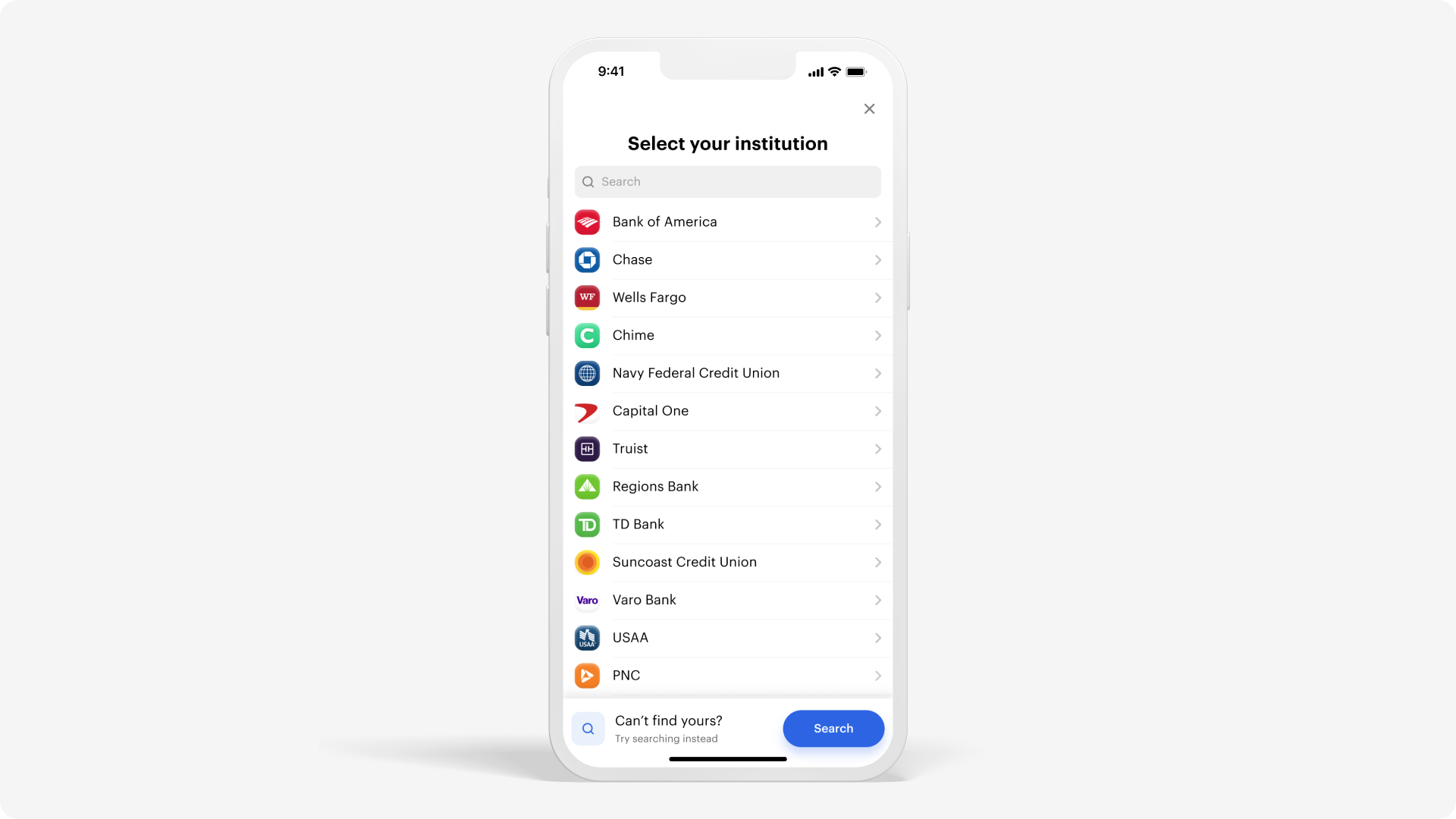

Financial accounts and income reports

Truv income reports share a comprehensive view of the user’s financial account. This information is an overview and includes historical information. This gives decision makers as much information as possible about a user’s financial account.

Truv simplifies connecting your users to their financial institution. Users can select their bank or credit union in Truv Bridge from the list of most popular financial institutions. They can also look for their financial institution in the search field at the top of the screen.

Report endpoints

These endpoints provide a comprehensive collection of financial account information from a user. View detailed information on the attributes and responses using the Income Report API reference page. The financial account response information is in the Example responses section below.

VOIE for Fannie Mae and Freddie Mac

Truv Verification of Income and Employment (VOIE) provides government sponsored enterprise (GSE) connectivity. With the appropriate configuration, generate and send user VOIE Reports directly to Fannie Mae and Freddie Mac. Simplify your users’ experience with a straightforward way of connecting their financial provider information.

Connecting multiple accounts

For users with more than one account, VOIE has the option to connect multiple accounts. During the connection process for users, users may have multiple tokens to exchange. Once the token exchanges are complete, use the Link information to retrieve or modify data in the user’s account.

User reports

During the verification process, generate user reports with the VOIE Reports endpoints in addition to retrieving information from the provider. These reports are available to send as needed.

Government sponsored enterprise (GSE) compatibility

VOIE report responses contain the gse_accepted field. With this Boolean value enabled, GSEs such as Fannie Mae and Freddie Mac accept the report as is. These two respond differently depending on the resulting reports available.

- Fannie Mae - Fully compatible reports are marked as GSE compatible

- Freddie Mac - GSE flagged reports may include incomplete or incompatible information

Bridge Token specifications

Each integrations requires additional values in the request when creating a Bridge Token for the User. These values are part of the process for the Implementing Income and Employment Steps guide.

All integrations use the income value for the product_type field. The integrations have separate data_sources field values as well. View more in the configurations section below.

- Document upload and Tax return collection -

product_type = income,data_sources = ["docs"] - Financial accounts -

product_type = income,data_sources = ["financial_accounts"]

Sample cURL configurations

The code sample below contains tabs for each of the integrations.

curl --request POST \

--url https://prod.truv.com/v1/users/{user_id}/tokens/ \

--header 'X-Access-Client-Id: {{client_id}}' \

--header 'X-Access-Secret: {{access_key}} ' \

--header 'accept: application/json' \

--header 'content-type: application/json' \

--data '

{

"product_type": "income",

"data_sources": ["docs"],

"tracking_info": "any data for tracking current transaction"

}

'curl --request POST \

--url https://prod.truv.com/v1/users/{user_id}/tokens/ \

--header 'X-Access-Client-Id: {{client_id}}' \

--header 'X-Access-Secret: {{access_key}} ' \

--header 'accept: application/json' \

--header 'content-type: application/json' \

--data '

{

"product_type": "income",

"data_sources": ["tax"],

"tracking_info": "any data for tracking current transaction"

}

'curl --request POST \

--url https://prod.truv.com/v1/users/{user_id}/tokens/ \

--header 'X-Access-Client-Id: {{client_id}}' \

--header 'X-Access-Secret: {{access_key}} ' \

--header 'accept: application/json' \

--header 'content-type: application/json' \

--data '

{

"product_type": "income",

"data_source": ["financial_accounts"],

"tracking_info": "any data for tracking current transaction"

}

'

Testing integrations

The sections below provide details for testing integrations. They include sample documents, credentials, and other test data.

Document processing and upload

When implementing VOIE in your workflow for document uploads, use the Testing guide to try different scenarios within the sandbox. The sections below and the Document processing testing page provide PDFs to upload and test various scenarios.

Document processing testing

When testing for Integrating Document Processing, the PDF downloads in the list below cover different scenarios for sandbox use.

Upload the documents for testing different sandbox response results. Pay statements and tax documents return data when successful. Unsuccessful uploads respond with status updates.

- Successful documents - Most recent paystub, Next recent paystub, First paystub, W2

- 1099 tax forms - 1099-DIV, 1099-G, 1099-INT, 1099-MISC, 1099-NEC, 1099-R, SSA-1099

Suspicious document detection

Documents from uploads may have fraudulent, consistent, or unacceptable data. When encountering these issues, mark specific instances for review. Prevent malicious activity with additional analysis and attention.

View the table below for various scenarios and PDF examples.

| Scenario | Description | Downloads |

|---|---|---|

| Tampered documents | Information is falsified or manipulated | Tampered 1, Tampered 2, Tampered 3 |

| Different Social Security Numbers | Personal information is inconsistent | SSN 1, SSN 2, SSN 3 |

| Different company names | Company information is inconsistent | Company 1, Company 2, Company 3 |

| Different applicant names | Personal information is inconsistent | Applicant 1, Applicant 2, Applicant 3 |

| Documents without data, or with invalid data | Information is missing or unable to be parsed | No data 1, No data 2, No data 3 |

NoteTest scenarios use the file name to return results. Testing ignores the file contents when in the sandbox.

Tax return credentials

When implementing VOIE in your workflow for Tax Returns, use the credentials below to try different scenarios within the sandbox.

| Username | Password | SSN | Scenario |

|---|---|---|---|

goodlogin.tax | goodpassword | 991-91-9991 | Successful login with complete data returned |

The table below covers the credentials available for testing error scenarios.

| Username | Password | Scenario |

|---|---|---|

error.user | login_error | Incorrect login and password |

error.user | mfa_error | Issue with multi-factor authentication |

error.user | account_locked | Locked account, requires provider unlock |

error.user | no_data | No data found in provider account |

error.user | unavailable | Provider is not available, maintenance issue |

error.user | error | Generic login error |

Example responses

The JSON data below contains sample report payloads for the integrations.

{

"id": "24d7e80942ce4ad58a93f70ce4115f5c",

"status": "new",

"finished_at": "2021-04-06T11:30:00Z",

"completed_at": "2021-04-06 11:30:00+00:00",

"access_token": "48427a36d43c4d5aa6324bc06c692456",

"tracking_info": "user123456",

"refresh_status": null,

"employments": [

{

"income": null,

"income_unit": null,

"pay_frequency": null,

"statements": [

{

"id": "24d7e80942ce4ad58a93f70ce4115f5c",

"check_number": null,

"pay_date": "2018-05-15",

"net_pay": "11500.32",

"net_pay_ytd": "31980.64",

"gross_pay": "13900.11",

"gross_pay_ytd": "49200.00",

"bonus": "100.00",

"commission": "12000.00",

"hours": "40.00",

"basis_of_pay": "S",

"period_start": "2018-05-01",

"period_end": "2018-05-15",

"regular": "1695.11",

"regular_ytd": "23000.00",

"other_pay_ytd": "700.00",

"bonus_ytd": "1000.00",

"commission_ytd": "24000.00",

"overtime": "45.00",

"overtime_ytd": "500.00",

"other_pay": "60.00",

"earnings": [

{

"name": "Regular",

"amount": "1935.77",

"category": "regular",

"rate": null,

"units": null

},

{

"name": "Overtime",

"amount": "60.58",

"category": "overtime",

"rate": "30.29",

"units": "2"

}

],

"earnings_ytd": [

{

"name": "Regular",

"amount": "1935.77",

"category": "regular",

"rate": null,

"units": null

},

{

"name": "Overtime",

"amount": "60.58",

"category": "overtime",

"rate": "30.29",

"units": "2"

}

],

"deductions": [

{

"amount": "127.01",

"category": "socialsec",

"name": "Social Security Tax"

},

{

"amount": "46.23",

"category": "state",

"name": "VA State Income Tax"

},

{

"amount": "29.7",

"category": "medicare",

"name": "Medicare Tax"

}

],

"deductions_ytd": [

{

"amount": "127.01",

"category": "socialsec",

"name": "Social Security Tax"

},

{

"amount": "46.23",

"category": "state",

"name": "VA State Income Tax"

},

{

"amount": "29.7",

"category": "medicare",

"name": "Medicare Tax"

}

],

"md5sum": "03639d6a6624f69a54a88ea90bd25e9d",

"file": "https://citadelid-resources.s3-us-west-2.amazonaws.com/paystub_sample.pdf",

"derived_fields": [

"basis_of_pay"

],

"missing_data_fields": [

"earnings_ytd"

]

}

],

"annual_income_summary": [

{

"id": "24d7e80942ce4ad58a93f70ce4115f5c",

"year": 2018,

"regular": "23000.00",

"bonus": "1000.00",

"commission": "24000.00",

"overtime": "500.00",

"other_pay": "700.00",

"net_pay": "31980.64",

"gross_pay": "49200.00"

}

],

"bank_accounts": [

],

"w2s": [

{

"file": "https://citadelid-resources.s3-us-west-2.amazonaws.com/W2_sample.pdf",

"md5sum": "f65e30c39124ad707ac4b3aeaee923a7",

"year": 2020,

"wages": "900.50",

"federal_tax": "75.01",

"social_security_wages": "900.50",

"social_security_tax": "56.30",

"medicare_wages": "900.50",

"medicare_tax": "13.15"

}

],

"id": "24d7e80942ce4ad58a93f70ce4115f5c",

"is_active": false,

"job_title": null,

"job_type": null,

"start_date": "2018-01-01",

"original_hire_date": null,

"end_date": "2022-06-16",

"external_last_updated": "2022-06-16",

"dates_from_statements": true,

"derived_fields": [

"is_active"

],

"missing_data_fields": [

],

"manager_name": "Jenny McDouglas",

"profile": {

"first_name": "John",

"last_name": "Doe",

"middle_initials": "K",

"email": null,

"ssn": "6789",

"date_of_birth": null,

"home_address": {

"street": "1 Morgan Ave",

"city": "Los Angeles",

"state": "CA",

"zip": "90210",

"country": "US"

}

},

"company": {

"name": "Facebook Demo",

"address": {

"street": "1 Morgan Ave",

"city": "Los Angeles",

"state": "CA",

"zip": "90210",

"country": "US"

},

"phone": null

}

}

],

"pdf_report": "https://citadelid-resources.s3-us-west-2.amazonaws.com/report.pdf",

"provider": "doc_upload",

"data_source": "docs"

}[

{

"id": "24d7e80942ce4ad58a93f70ce4115f5c",

"document_type": "F1040",

"document_subtype": "",

"file": "https://citadelid-resources.s3-us-west-2.amazonaws.com/tax_sample.pdf",

"md5sum": "24d7e80942ce4ad58a93f70ce4115f5c",

"year": 2019

}

]{

"status": "success",

"completed_at": "2022-05-04T11:30:00Z",

"days_requested": 61,

"tracking_info": "any string",

"provider": "bank_of_america",

"access_token": "99dd17074ac94aa9ace2621d657c7610",

"companies": [

"my employer"

],

"accounts": [

{

"id": "24d7e80942ce4ad58a93f70ce4115f5c",

"created_at": "2022-05-04T11:30:00Z",

"updated_at": "2022-05-04T12:00:00Z",

"type": "CHECKING",

"subtype": "MONEY_MARKET",

"mask": "string",

"nickname": "My account"

}

],

"income": [

{

"start_date": "2022-05-04",

"end_date": "2022-05-04",

"account_id": "24d7e80942ce4ad58a93f70ce4115f5c",

"income_description": "Paycheck",

"income_category": "Income: Paycheck",

"pay_rate": 0,

"pay_frequency": "SM",

"total_amounts": [

{

"amount": "200.31",

"iso_currency_code": "USD"

}

],

"transaction_count": 7,

"historical_summary": [

{

"start_date": "2022-05-04",

"end_date": "2022-05-04",

"total_amounts": [

{

"amount": "200.31",

"iso_currency_code": "USD"

}

],

"transactions": [

{

"amount": "200.31",

"iso_currency_code": "USD",

"date": "2022-05-04",

"check_number": "string",

"description": "string",

"pending": true,

"transaction_id": "3fa85f64-5717-4562-b3fc-2c963f66afa6"

}

]

}

]

}

],

"summary": {

"start_date": "2022-05-04",

"end_date": "2022-05-04",

"income_sources_count": 2,

"income_categories_count": 1,

"income_transactions_count": 17,

"total_amounts": [

{

"amount": "200.31",

"iso_currency_code": "USD"

}

]

},

"is_suspicious": false

}Updated 12 days ago